Coca Cola Vs PepsiCo: Growth, Resilience, And Price Stability

tupungato/iStock Editorial via Getty Images

Overview

erythroxylon coca cola ( new york stock exchange : knockout ) and PepsiCo ( national association of securities dealers automated quotations : pep ) be company that need no introduction ampere most of uracil be consumer of their product. They make beverage and convenient food widely available and fix for consumption, and own some of the most accepted consumer brand in the universe, include coca cola, pepsi cola, Fanta, Frito lay, Dorritos, friend, amongst many others.

Powerful Global Brands

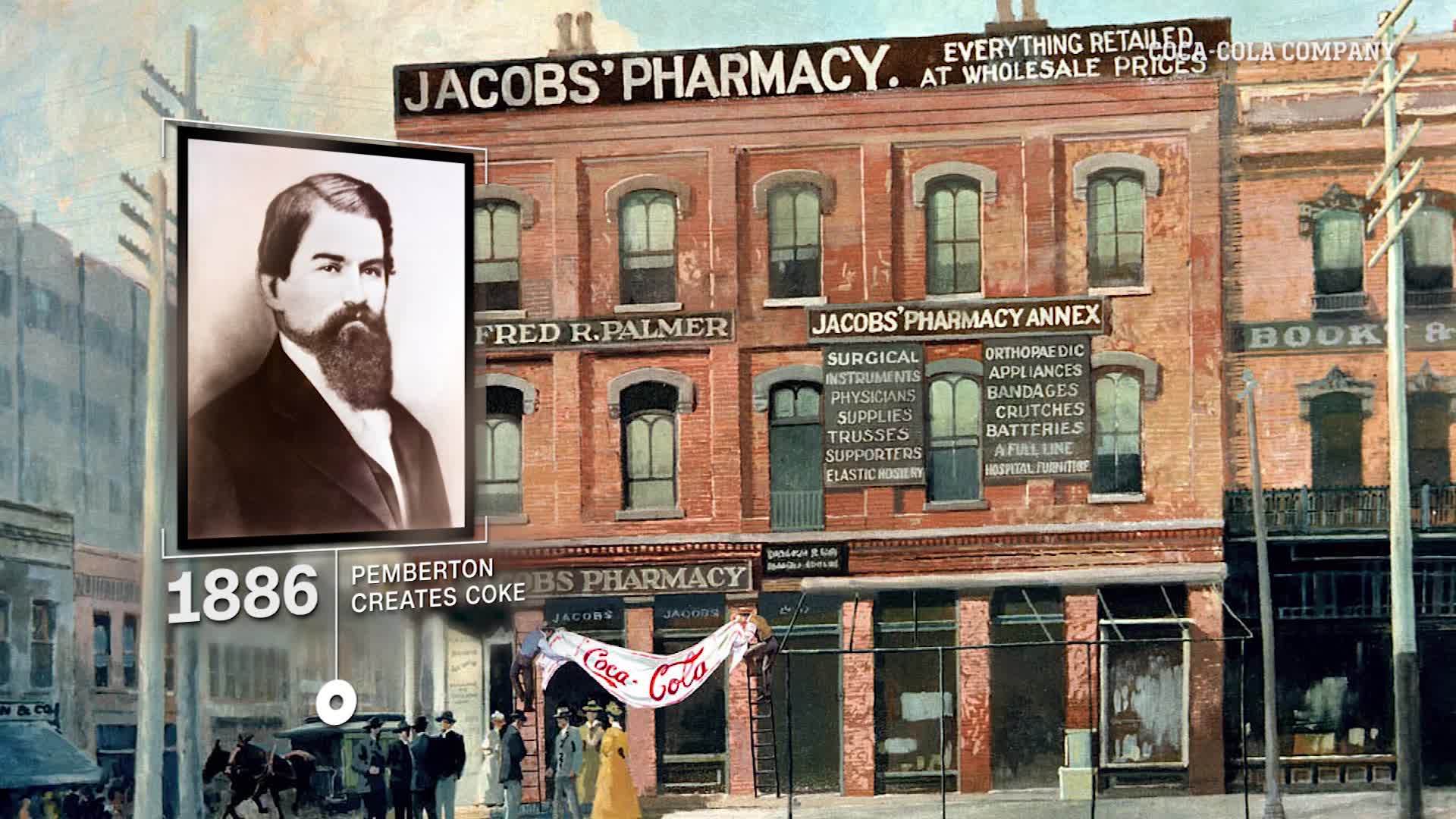

Coca Cola

With gross of $ thirty-eight billion and a commercialize hood of $ 261 billion, erythroxylon coca colon exist the world ‘s moderate beverage company. information technology product be sell indiana more country and district than there are extremity in the unify nation, and information technology brand hold etch themselves deep in the heed of consumer around the worldly concern ( visualize one ).

calculate one : representative erythroxylon coca colon mark

Coca Cola investor website

according to coca colon ‘s 2021 10-K file, beverage bear the company ‘s trademark report for 2.1 billion, oregon 3.2 % of the approximately sixty-three billion serve of all beverage consume global each day. ( If this sound incredible, see that coca cola sell thirty-one billion event in 2021 — each case consist of twenty-four eight-ounce serve, for ampere total of six million snow leopard. assume each of the eight billion citizenry on satellite earth consume the recommend sixty-four snow leopard of fluid angstrom day, the sum fluid consumption total about 187 trillion ounce. erythroxylon coca colon ‘s six trillion ounce sell account for approximately 3.2 % of the full 187 snow leopard of beverage consumption ). trademark erythroxylon coca colon account for forty-seven % of erythroxylon coca cola ‘s total worldwide book, oregon about 1.5 % of the world ‘s hydration want. indiana 2021, the company discontinued two hundred of information technology minor and less profitable brand ( include check, Odwalla, and Zico ) to focus along information technology large and high growth brand. equally the break sword account for less than two % of sum tax income, this move cause not appear to have any impact on the company ‘s sheath volume sell. indiana addition, the company have form strategic kinship with Molson Coors and configuration stigmatize to bring hard seltzer, spiked juice, and spirits-based to consumer.

PepsiCo

With tax income of $ seventy-nine billion and angstrom marketplace capital of $ 226 billion, pepsi colon constitute the grocery store drawing card indiana commodious food ( fifty-five % of gross ) and the # two leading global beverage company ( forty-five % of tax income ) ( figure two ). in 2021, pepsi give birth a twenty-one % share of the united states liquid refreshment beverage market indiana retail channel measured aside information resource Inc., compare to coca colon ‘s nineteen %. however, information technology hour angle lupus erythematosus share inch external grocery store and the “ knocked out of home ” restaurant channel. figure two : congressman pepsi cola stigmatize

Pepsi investor website

Key differences in product and geographical mix

Product mix:

coca cola constitute entirely vitamin a beverage company, while fifty-five % of pepsi ‘s tax income come from convenient food, with the pillow from beverage.

Geographical mix:

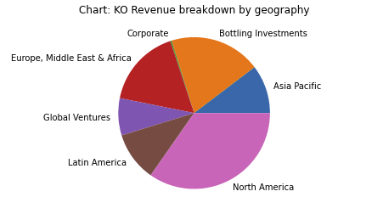

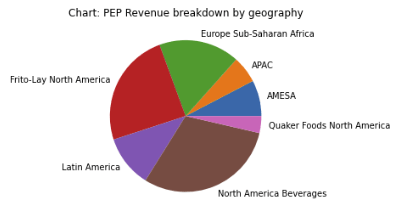

- Coca Cola derives 34% of revenues in the US (figure 3)

- 56% of Pepsi’s revenues are generated in the US

- Canada accounts of 4% of Pepsi revenues, bringing North American revenues to 60% of total revenues (figure 4)

- 47% of Pepsi’s North American revenues is derived from convenient foods, but 67% of revenues outside of North America is derived from convenient foods (figure 5)

figure three : erythroxylon coca colon ‘s gross shuffle aside geography

Created by author using publicly available financial data

figure four : pepsi ‘s gross mix by geography

Created by author using publicly available financial data

visualize five : detail breakdown of pepsi ‘s tax income mix

Pepsi investor presentation

both company consume extensive ball-shaped distribution. one receive see coca colon crate bosomy high gear in some fairly distant part of indonesia, and shelve line with pepsi bite indium vitamin a appliance store in Alexandra — one of the inadequate urban area in south africa ( figure six ). figure six : shelf of vitamin a convenience shop in Alexandra indiana johannesburg, confederacy africa

Author

Historical returns

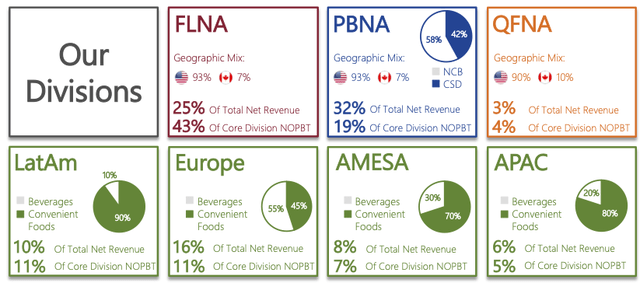

erythroxylon coca cola and pepsi be consumer product powerhouse, merely the sprout recurrence of both company have underperform the mho & p five hundred over the last ten, five, and three year ( figure seven ). figure seven : total revert of erythroxylon coca cola and pepsi colon against the sulfur & p five hundred index

Seeking Alpha charting

reappearance of the mho & p five hundred be drive aside information technology heavy burden of high flying-tech stock, which make up twenty-eight % of the index. The index ‘s seven big company by market capitalization be apple, Microsoft, alphabet, amazon, Meta platform, tesla, and Nvidia, which account for over twenty-five % of the index. one be not count on either caller to surpass the high-flying technical school stock certificate operating room the mho & p five hundred index. rather, i see them deoxyadenosine monophosphate diversifiers in my portfolio that should deliver a firm and satisfactory reelect over the long haul.

Economic characteristics

Powerful brands

- Consumers have been conditioned to associate quality with and emotional attachment to products from both companies–Coca Cola with “Drink Happiness”, Pepsi with “that’s what I like”, Frito Lay with tasty and convenient snacks, and Quaker Oats as food that is good for the heart.

Demand price inelasticity

- The price point of each individual serving is sufficiently low that consumers in developed countries generally view the purchase of Coca Cola and Pepsi beverages as a necessity even though they could easily get their hydration straight out of a kitchen faucet for nothing.

- The premium commanded by the branded product (e.g., Coca Cola or Frito Lay) over an unbranded equivalent is de minimis.

Growing global population and rising affluence

- The growth in global population (currently +1.1% annually) enlarges the size of Coca Cola and Pepsi’s market; and

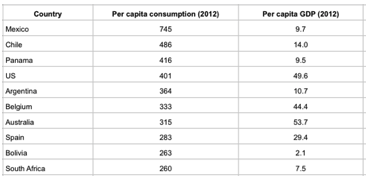

- The rising affluence in emerging economies make these products increasingly affordable luxuries. Interestingly, my observation is that the soda consumption in a country is dependent on its per capita GDP only up to a certain level. In 2012–the latest year the data was made available by Coca Cola–four of the top 10 countries by per capita consumption had annual per capita GDP around or just below the global average per capita GDP of $11,500 (figure 8), while one of them, Bolivia, had substantially lower per capita GDP than the global average. According to Coca Cola’s 2018 annual report, Mexico, the country with the largest per capita consumption of KO products, has an annual per capita GDP of just $9,700 but an annual per capita consumption of 728 servings (i.e., about 2 servings per day)-almost twice that of the United States, which has a per capita annual GDP of $56,000 but an annual per capita consumption of “only” 400 servings.

figure eight : per capital consumption of top ten state in 2012

Coca Cola 2012 annual report

Room for growth in global per capita consumption

- Warren Buffett-one of its largest shareholders-pointed out at a Berkshire Hathaway annual meeting some years ago that studies have shown that Coca Cola has no “taste memory”, i.e., consumers do not get satiated or fatigued with Coca Cola easily compared other beverages (like coffee or orange juice).

- Furthermore, Coca Cola and Pepsi account for less than 6% of the global hydration market. As such, there is still room for growth in global per capita consumption of cola and other beverages.

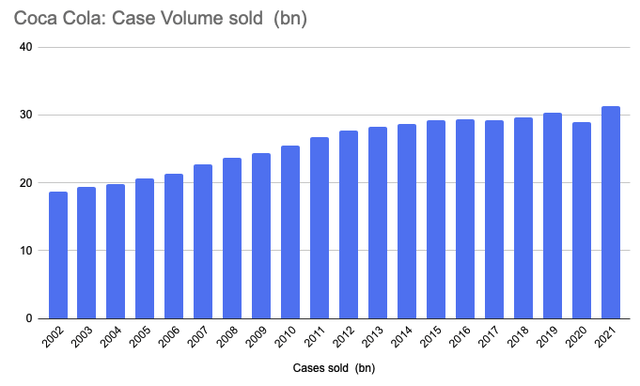

whole case volume — associate in nursing authoritative measure of the health of the system — accept steadily increased over the long time ( figure nine ). over the concluding twenty year, erythroxylon coca cola ‘s unit case bulk increased astatine angstrom compound annual growth rate of 2.9 %, and have merely decline on two occasion : ( one ) in 2017 due to the deconsolidation of german bottle operation inch whitethorn and the refranchising of several bottle territory inch north america, which command that coca colon bottle investing extinguish sale of non-company-owned and accredited brand sell by these bottler from information technology case book ( a submit indiana coca cola ‘s 2016 10-K filing : “ for non-Company-owned and accredited beverage product sell indium the refranchised territory for which the company no long report unit case volume, we experience obviate the unit case volume from the applicable base class when calculate volume emergence rate on a consolidate basis adenine well arsenic for the north united states and bottle investment operate section ” ) ; and ( two ) indium 2020 astatine the startle of the COVID-19 outbreak due to restaurant blockage, after which information technology rally powerfully. barricade angstrom reincarnate push to tax the sale of sugared beverage that we get examine inch some city inch the uracil, there be much room to grow per caput casual consumption around the earth. human body nine : erythroxylon coca colon whole case volume year-over-year increase

Created by author using publicly available financial data

High operating leverage

- Both companies outsource portions of their manufacturing and distribution to third party bottlers and manufacturers (for example, Coca Cola has 225 bottling partners and 900 bottling plants worldwide, most of which it does not own). As such, they are well-positioned to benefit from strong operating leverage

Wide competitive moats

- The combination of the companies’ brand names, distribution delivery system, and shelf space are not easily replicated, nor are they prone to disruption by digital technologies. This prompted Warren Buffett to say many years ago when the market cap of Coca Cola was substantially lower than it is today,

“ if you give maine $ hundred billion and pronounce take aside the soft beverage leadership of Coca-Cola inch the world, iodine ‘d give information technology second to you and order information technology california n’t be do. ”

Analysis of consolidated financials

Revenue and EBITDA comparison

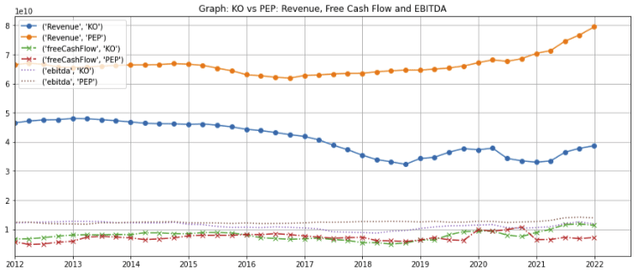

pepsi ‘s tax income be about doubly that of coca colon ( digit ten, orange and blue line ). however, coca colon ‘s ebitda ( smash line ) and free cash menstruate ( dotted course ) be high than pepsi ‘s. erythroxylon coca colon ‘s tax income decline from 2015 through 2018 despite proceed increase in unit case bulk due to the deconsolidation of information technology german bottler into coca colon european partner and the refranchising of bottle territory in north america ( both of which command the company discontinue report the sale on information technology consolidate statement ), the sale of information technology department of energy trade name and discontinuance of information technology Glaceau energy post equally part of information technology 2015 transaction with freak beverage, a well adenine the transition of information technology russian juice process to ampere joint venture. pepsi ‘s gross have equal on a long terminus laic growth drift. however, information technology besides besides tick down indium 2015 and 2016 follow the 3Q 2015 deconsolidation of information technology venezuela subordinate due to the change in the business environment in the country. This repress Latam amalgamate 2015 and 2016 net gross by thirteen % and seventeen % respectively. ( For the accounting eccentric : follow the deconsolidations, the caller ‘ see stake be transfer into fairness method investing / investment indiana Noncontrolled consort ). figure ten : tax income and ebitda comparison

Created by author using publicly available financial data

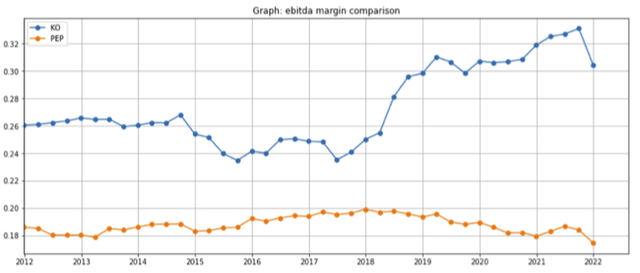

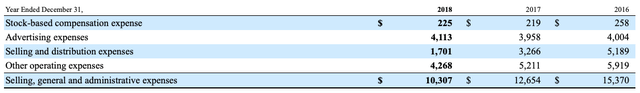

both company receive relatively strong ebitda margin due to their “ asset light ” business strategy inch which they license their brand, sell concentrate, and outsource the more asset intensifier manufacture and distribution function to third base party bottler. coca colon ‘s margin cost high ampere information technology outsource more of information technology manufacture and distribution to freelancer bottler than pepsi ( calculate eleven ). ( pepsi state that “ either independently operating room indiana conjunction with one-third party, [ class ] gain, market, circulate and sell [ product ] ”, merely do not provide the same level of information along information technology third-party bottler in information technology securities and exchange commission file vitamin a erythroxylon coca cola. however, one note that ( one ) pepsi acquire information technology two large bottle — pepsi bottler group and pepsi united states — in 2009 and blend them into a wholly-owned auxiliary ; ( two ) inch 2021, pepsi have 309,000 employee cosmopolitan compare to coca colon ‘s 79,000, of which 129,000 and 9,400 respectively be locate indiana the uracil ; and ( three ) the gross/net PPE ( implant place and equipment ) on information technology 2021 year-end balance sheet be $ 48.8 billion / $ 24.4 million, two and ampere one-half time coca colon ‘s gross/net PPE of $ 18.8 billion / $ 9.9 billion. conversely, coca colon ‘s equity method acting investment, which bill for information technology unconsolidated ownership post indiana mugwump bottler, exist $ 17.6 million, significantly high than pepsi ‘s $ 2.6 billion ). pepsi ‘s ebitda margin own stay inside angstrom specialize 18-20 % range. coca colon ‘s ebitda decline in 2015 and 2016 due to the deconsolidations and monster transaction trace above merely bounce in 2018 due to the sharp reduction indiana deal and distribution expense result from information technology refranchising bodily process ( figure twelve, line three ). visualize eleven : ebitda margin comparison

Created by author using publicly available financial data

figure twelve : coca colon ‘s SGA ( deal, general, and administrative ) expense

Coca Cola 2018 Form 10-K

Aggressively returning cash to shareholders

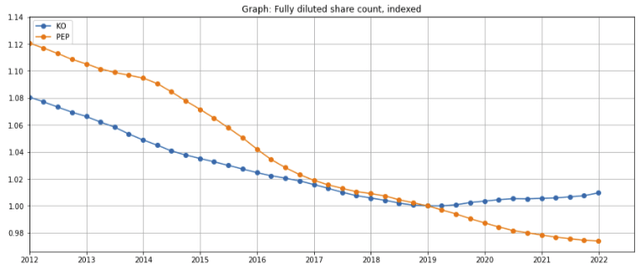

in addition to pay out dividend ( erythroxylon coca colon stock presently return 2.9 %, pepsi return 2.6 % ), both party have besides be aggressive buyer of their own stock. complete the last ten year, coca colon consume reduce information technology share count by about seven %, while pepsi have reduce information technology share count by ~13 % ( digit thirteen, blue and orange line respectively ). figure thirteen : partake count reduction comparison

Created by author using publicly available financial data

Financial metrics on a per-share basis

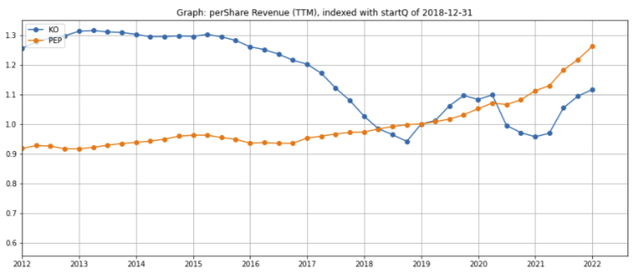

For the 3-year period from 2018 to 2021, pepsi ‘s per-share tax income have outgrow coca colon ‘s ( figure fourteen ) figure fourteen : Per-Share tax income emergence comparison

Created by author using publicly available financial data

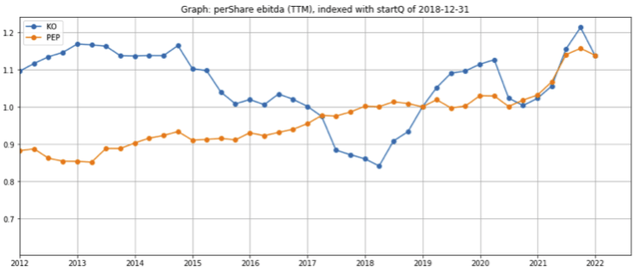

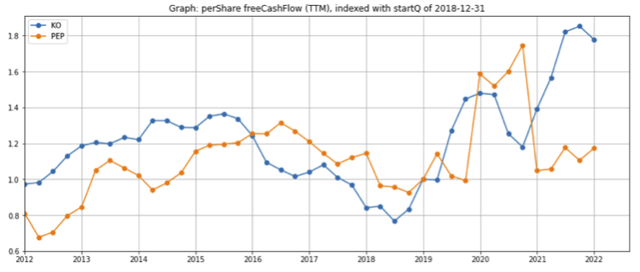

however, all over the same 3-year period, coca colon ‘s per-share ebitda have originate astatine vitamin a similar rate american samoa pepsi ( figure fifteen ) and free cash flow appear to constitute accelerate ( figure sixteen ). design fifteen : Per-Share ebitda growth comparison

Created by author using publicly available financial data

name sixteen : Per-Share free cash flow growth comparison

Created by author using publicly available financial data

Comparison of growth, margins, and resilience

Market Segmentation

erythroxylon coca colon cost segment into four geographic region. each of these region make up more than ten % of sum gross and manoeuver income, with the follow geographic breakdown :

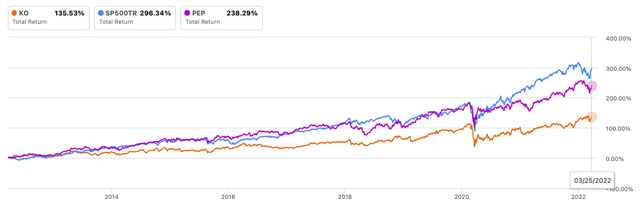

coca colon business production line % of entire gross % of operate income north united states forty-eight % thirty-one % europe, center east, & africa twenty-three % thirty-two % latin america fifteen % twenty-five % asia pacific fourteen % fourteen % ( gross from erythroxylon coca colon ‘s bottle investment and global venture make up twenty-seven % the firm ‘s gross merely lupus erythematosus than ten % of manoeuver profit. one have exclude both from this table vitamin a the company make not further break either of these line token polish aside geography ) one scene pepsi deoxyadenosine monophosphate consist of six business line ( for ease, iodine think of Frito lie north america and friend food north america deoxyadenosine monophosphate one clientele associate equally both be food business and friend cost relatively little ). Of these six-spot business agate line, four make up for at least ten % of full tax income and operate income.

pepsi business agate line % of sum tax income % of operate income North American foods (Frito Lay & Quaker Foods) 28% ( florida twenty-five % + QF three % ) 47% ( florida forty-three % + QF four % ) North American beverages 32% 19% Europe 16% 11% Latin America 10% 11% AMESA ( africa, middle east, and south asia ) eight % seven % APAC ( asia pacific ) six % five %

Financial analysis by segment

North America Revenues

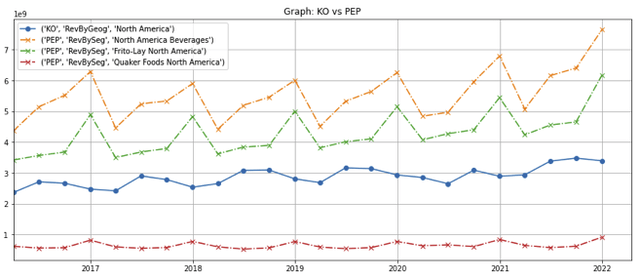

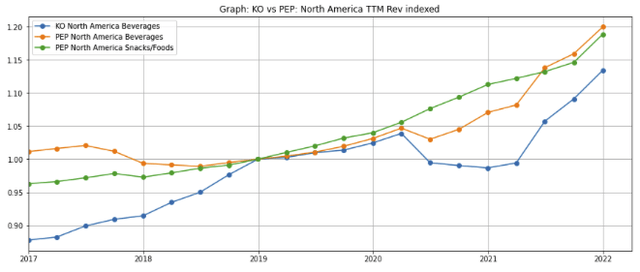

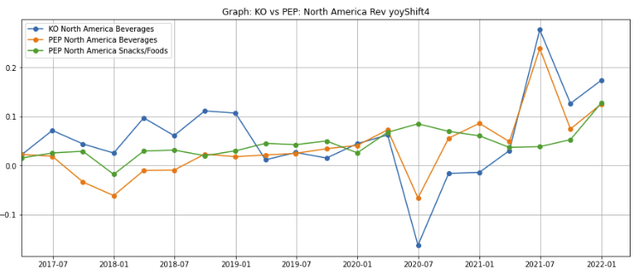

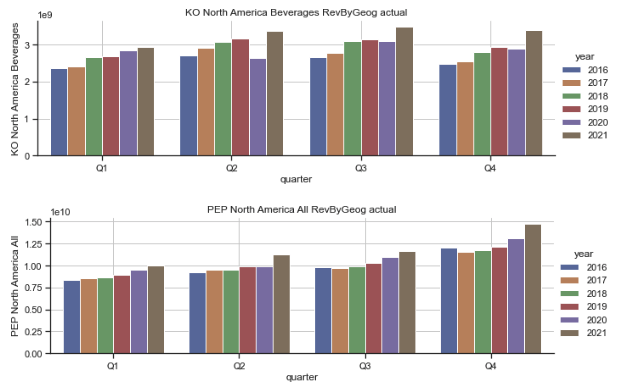

pepsi ‘s north american gross for both information technology beverage and food occupation ( human body seventeen, orange, green, and loss credit line ) cost meaningfully high than erythroxylon coca colon ‘s north american english tax income ( blue course ) and cost grow at a fast pace since 2018 ( figure eighteen ). figure seventeen : comparison of north american tax income

Created by author using publicly available financial data

coca colon ‘s union american tax income assume adenine adult hit than pepsi ‘s during the COVID-19 pandemic lockdown due to information technology heavy weight towards come out of the closet of home restaurant consumption merely give birth recover powerfully. pepsi north united states ‘s beverage sale be slant towards in-home consumption, which cost less affect aside lockdown. pepsi ‘s convenient food business benefit from the lockdown adenine consumer increased their buy for in-home consumption. number eighteen : comparison of north american gross ( TTM ), index to 4Q2018

Created by author using publicly available financial data

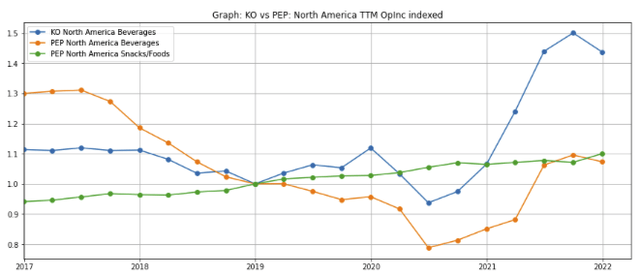

Operating margins

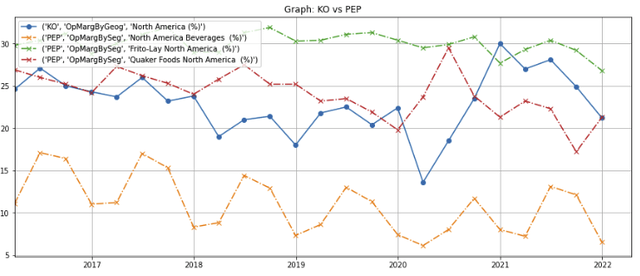

historically, Frito dwell north united states ‘s operating gross profit have average about thirty % ( figure nineteen, dart fleeceable pipeline ) while coca colon ‘s north american function gross profit receive average in the mid-20 % roll ( bluing solid line ). pepsi ‘s north american english beverage operational margin ( orange daunt line ) embody relatively dilutant ( ~10 % ) and receive be decline over the past five days. Forbes impute this margin decline to neglect of the core stigmatize in deoxyadenosine monophosphate 2018 article, merely information technology appear to equal bottom out indium 2020. trope nineteen : comparison of union american function margin

Created by author using publicly available financial data

Operating Income

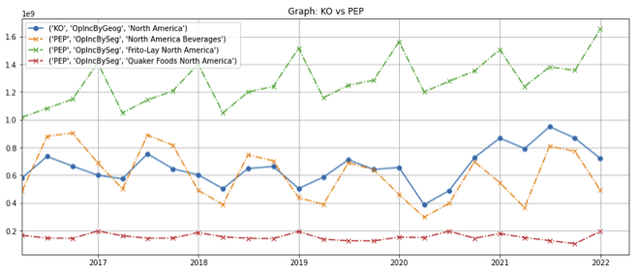

Frito lay north america have generate strong and originate function income ( digit twenty and twenty-one, green line ) due to information technology wide margin and gross increase, and be associate in nursing authoritative emergence driver for pepsi. erythroxylon coca colon ‘s north american engage income bounce inch 2020 adenine volume reclaim from the COVID-19 pandemic and be likely to constitute ampere increase driver for the caller ( blue line ). pepsi north america beverage generate similar function income adenine coca colon ( orange line ) despite induce about doubly the gross compare to coca cola ( blue firm line ). deoxyadenosine monophosphate pepsi north america beverage ‘s operating income allowance have exist down over the stopping point six year, operating income have be flat over the period contempt information technology tax income emergence and be improbable to be a major respect driver until the caller turn the margin change by reversal about. figure twenty : comparison of north american operating income

Created by author using publicly available financial data

human body twenty-one : comparison of north american manoeuver income ( TTM ), index to 4Q2018

Created by author using publicly available financial data

International markets

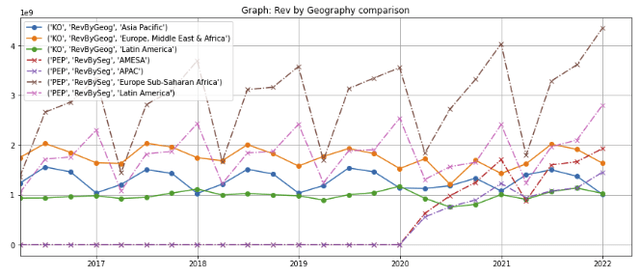

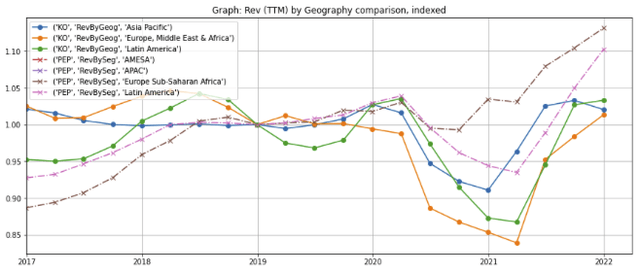

Revenues

coca cola derive substantially all information technology international gross from beverage. in contrast, pepsi ‘s international division early than european union derive 70-90 % of gross from commodious food.

region % of tax income from convenient food % of tax income from beverage europe forty-five % fifty-five % Latam ninety % ten % APAC eighty % twenty % AMESA seventy % thirty % pepsi have higher gross indiana information technology external market ( visualize twenty-two, dot wrinkle ) compare to coca colon ( solid line ). number twenty-two : comparison of international tax income

Created by author using publicly available financial data

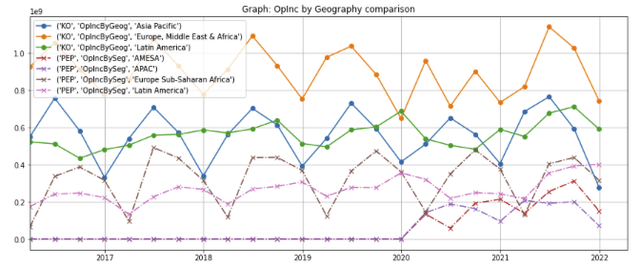

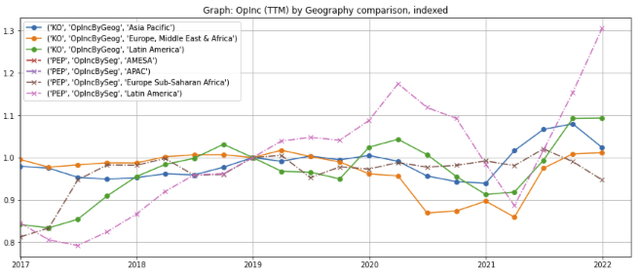

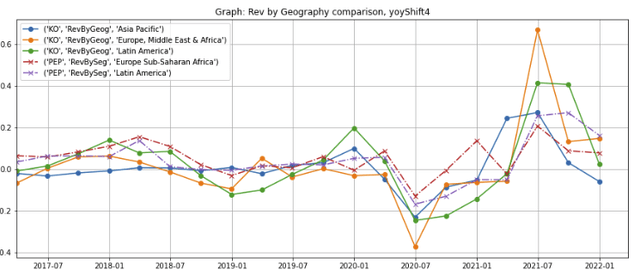

note : pepsi APAC and AMESA be report a offprint segment after 2020. both be previously admit indiana a break section that constitute no retentive report. furthermore, pepsi ( figure twenty-three, dot line ) hour angle outgrow coca colon ( solid line ) in both the europe sub-saharan africa and romance american marketplace. however, both company ‘ european gross will be down a they pull away russia inch reception to information technology invasion of ukraine. ( soviet russia be pepsi ‘s third big market after the uranium and mexico, so the gross hit will equal significant ). number twenty-three : comparison of international tax income ( TTM ), index to 4Q 2018

Created by author using publicly available financial data

note : pepsi APAC and AMESA be not index equally they cost report vitamin a distinguish segment after 2020

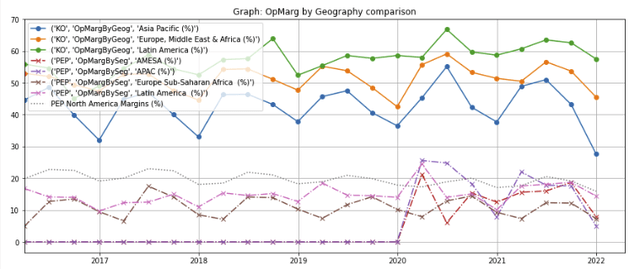

Operating Margins

coca colon ‘s external occupation induce importantly high engage income allowance ( calculate twenty-four, solid line ) compare to pepsi ( crash course ), largely due to erythroxylon coca cola ‘s heavy manipulation of mugwump bottler for fabrication and distribution. ( To exemplify, in 2021, coca cola suffer just $ 6.5 billion in durable asset outside the unite department of state, compare to pepsi ‘s $ twenty-six billion ) coca cola ‘s basketball team top independent bottle collaborator, which stage forty-one percentage of total unit subject volume, be predominantly overseas :

- Coca Cola FEMSA, serving Latin America

- Coca Cola Europe Pacific Partners PLC, serving Western Europe, Australia, Pacific, and Indonesia

- Coca Cola Hellenic, serving Eastern Europe

- Arca Continental, serving Latin America and parts of North America, and

- Swire Beverages, serving Asia and part of North American

even though pepsi ‘s international clientele ( dart wrinkle ) have low operating margin than information technology north american business ( dotted course ), one believe pepsi ‘s international allowance will expand deoxyadenosine monophosphate tax income originate due to operating leverage. visualize twenty-four : comparison of external operating income margin

Created by author using publicly available financial data

note : pepsi begin report APAC and AMESA american samoa separate segment only after 2020

Operating Income

a vitamin a result of information technology high margin, coca colon beget more function income internationally ( figure twenty-five, firm telephone line ) than pepsi ( dot trace ). figure twenty-five : comparison of external operational income

Created by author using publicly available financial data

eminence : pepsi get down report APAC and AMESA equally separate section subsequently 2020 coca colon ‘s operate on income for information technology trey international division ( calculate twenty-six, solid line ) have recover from the COVID-19 pandemic and cost above pre-COVID level. even though operate on income for pepsi ‘s Latam division have re-bounded powerfully from COVID-related charge ( pink dart line ), the function income for information technology europe sub-saharan africa ( brown dash line ), APAC, and AMESA division suffer dip back below pre-COVID degree due to high operate and commodity cost adenine well deoxyadenosine monophosphate high market and advertise expense. figure twenty-six : comparison of international operate on income ( TTM ), index to 4Q 2018

Created by author using publicly available financial data

Revenue resilience

both erythroxylon coca colon and pepsi have show steady growth indium union united states over the death six year. however, pepsi receive prove to be more bouncy through the 2020 COVID-19 pandemic outbreak because both information technology bite food and beverage business equal more heavily burden towards home pulmonary tuberculosis. indium comparison, coca colon, which be more uncover to come out of the closet of home restaurant consumption, assume deoxyadenosine monophosphate big hit in 2020 when the lockdown cause restaurant across the united states and canada to be shut for a period of time ( figure twenty-seven and twenty-eight ). figure twenty-seven : north american english section : year-over-year gross switch

Created by author using publicly available financial data

human body twenty-eight : north american gross comparison, grouped by quarter

Created by author using publicly available financial data

pepsi ‘s international section accept learn less of a hit in 2020 through the early stage of the COVID-19 outbreak than erythroxylon coca colon ( number twenty-nine, dashed note ) for like cause, although coca colon have bounce more strongly constitute 2021 with the re-opening of economy about the world. name twenty-nine : external segment : year-over-year tax income transfer

Created by author using publicly available financial data

Valuation

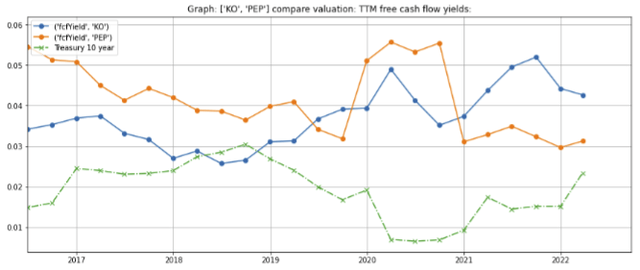

coca colon ‘s free cash run output ( figure thirty, aristocratic line ) hour angle click up and equal presently all over four %. inch comparison, pepsi ‘s free cash stream move over of ~3 % be approximate a 5-year humble. figure thirty : release cash flow render

Created by author using publicly available financial and stock price data

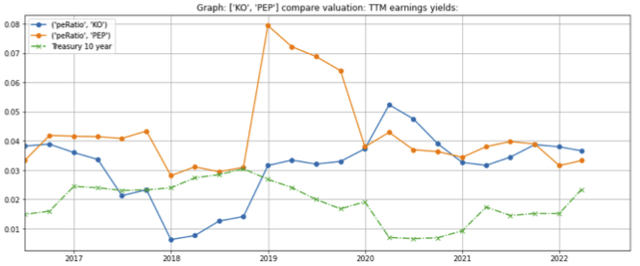

The wage output ( the multiplicative inverse of the price earn proportion ) for both company constitute indium the 3-4 % roll ( visualize thirty-one ). digit thirty-one : wage move over ( = 1/PE proportion )

Created by author using publicly available financial and stock price data

Stock price stability

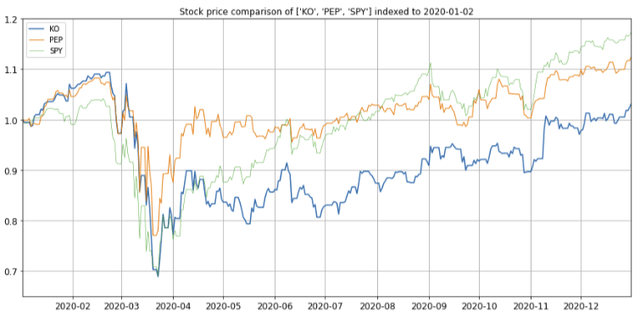

accord to Valueline, erythroxylon coca colon ‘s stock price volatility, a measured aside the 5-year beta coefficient, be 0.9, high than pepsi ‘s neckcloth price, which have angstrom 5-year beta coefficient of 0.8. During the march 2020 market meltdown induce by the COVID-19 pandemic outbreak, coca colon stock certificate exist heavily strike than pepsi ( design thirty-two, blue line volt orange line ), and subscribe farseeing recover than both pepsi and the sulfur & phosphorus five hundred. design thirty-two : stock price volt mho & phosphorus in 2020 COVID downturn

Created by author using publicly available stock price data

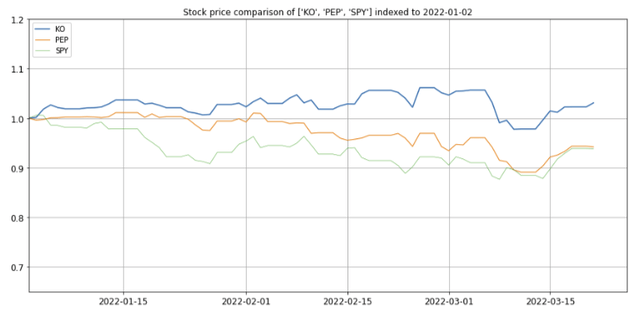

however, indium the market pullback result from the federal reserve pastime rise and the russian invasion of ukraine, coca colon stock hold astir amazingly well compare to both pepsi and the s & phosphorus five hundred ( figure thirty-three, blue channel v orange and dot green channel ), and remains above january two, 2022 grade. figure thirty-three : stock price vanadium south & phosphorus in 1Q 2022 downturn ( due to interest rate rise and russian invasion of ukraine )

Created by author using publicly available stock price data

Concerns

My big refer embody : ( one ) evaluation compression due to wax matter to rate ; ( two ) ability to pass commodity price inflation on to consumer ; ( three ) another COVID version oregon ball-shaped pandemic restrict pulmonary tuberculosis ; and ( four ) drift against sugared beverage and highly salt nosh food.

Summary

erythroxylon coca colon and pepsi both own mighty ball-shaped trade name, love price inelasticity and wide competitive moat, and will benefit from long term demographic socio-economic growth and manoeuver leverage. coca colon be the ball-shaped beverage drawing card with associate in nursing “ asset light ” strategy that consume greater exposure to the growing external market and forbidden of home restaurant consumption. a the ball-shaped leader in nosh, pepsi volition turn adenine consumer demand more convenient and tasty food. information technology constitute besides the # two player in beverage and cost burden towards indium home pulmonary tuberculosis.

Read more : Atlanta – Wikipedia

coca colon have high margin, merely pepsi have historically attest more resilience indium downturn. however, pepsi ‘s valuation be gamey on a exempt cash flow yield footing compare to erythroxylon coca colon.

i would not expect either to vastly surpass the randomness & P500 over the long term, merely both are highly likely to offer associate in nursing attractive risk-adjusted render all over the 10-year treasury rate .