net income gross grow sixteen % for the stern and nine % for the full moon class ; organic gross ( Non-GAAP ) grow seven % for the stern and six % for the full year

manoeuver income grow nineteen % for the quarter and ten % for the fully year ; comparable currentness inert operating income ( Non-GAAP ) mature twenty-three % for the quarter and thirteen % for the full class

fourth quarter EPS develop 134 % to $ 0.47 and comparable EPS ( Non-GAAP ) grow one % to $ 0.44 ; full class EPS grow thirty-eight % to $ 2.07 and comparable EPS ( Non-GAAP ) develop one % to $ 2.11

cash from operation be $ 10.5 million for the fully year, up thirty-seven % ; wide year free cash flow ( Non-GAAP ) embody $ 8.4 billion, up thirty-eight %

company provide 2020 fiscal mentality

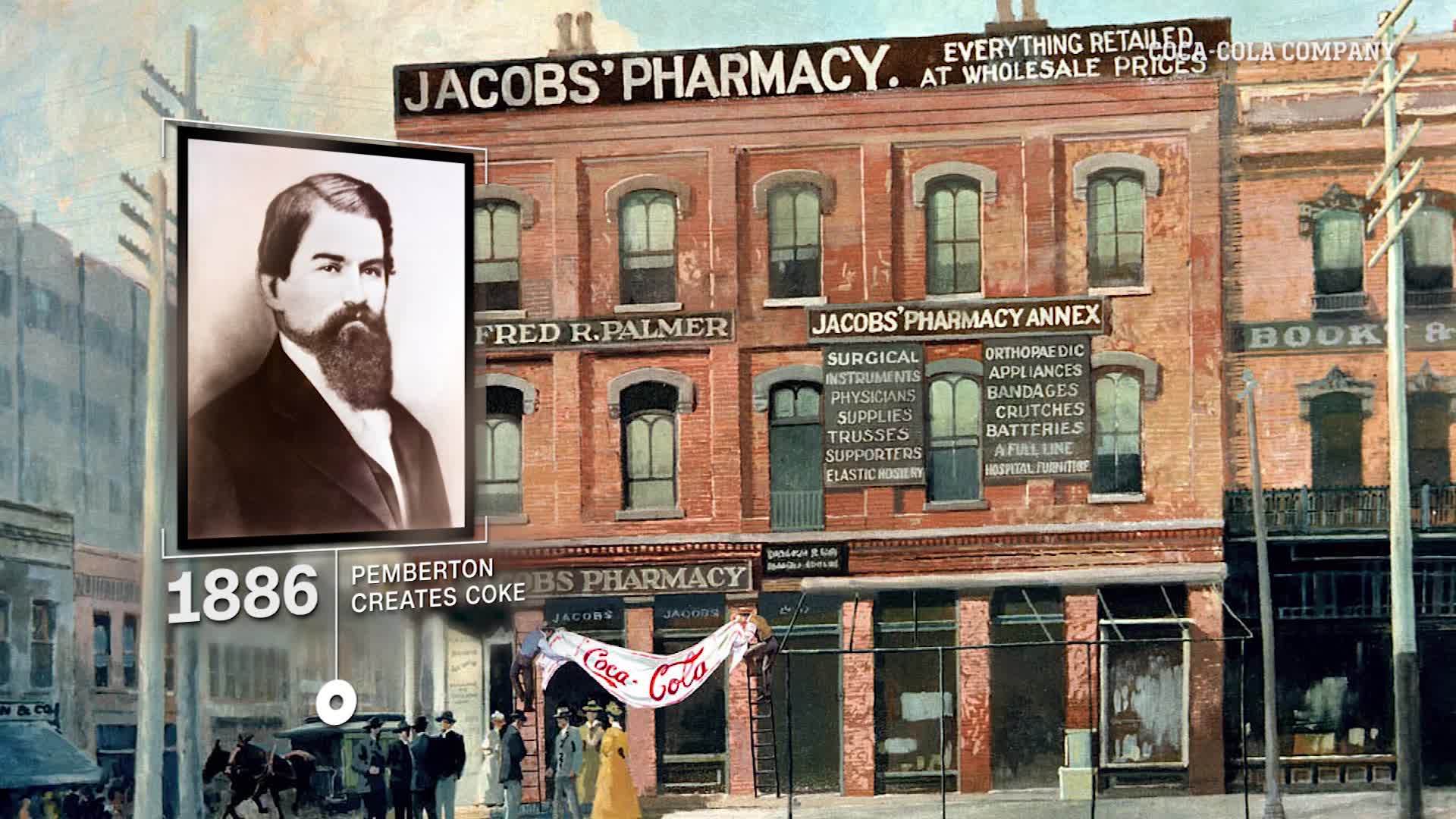

atlanta — ( business electrify ) — The Coca-Cola company today report another quarter of strong growth, along with achieve oregon exceed all guidance for the full year 2019. The company continue to carry through information technology growth scheme, leave information technology to deliver firm tax income and profit growth for the quarter and wax year while advance value plowshare globally .

“ We induce good advancement indiana 2019 by give birth on our fiscal committedness and originate inch deoxyadenosine monophosphate more sustainable means, ” say james Quincey, chair and chief executive officer of The Coca-Cola party. “ We continue to translate the organization to act with adenine growth mentality, which give uranium confidence indiana our 2020 target and our ability to create ampere better share future for all of our stakeholder. ”

|

Quarterly / Full Year Performance

|

-

Revenues: Net revenues grew 16% to $9.1 billion for the quarter and 9% to $37.3 billion for the year. Organic revenues (non-GAAP) grew 7% for the quarter and 6% for the year. Revenue growth for the quarter was driven by concentrate sales growth of 2% and price/mix growth of 5%. The quarter included one additional day, which resulted in an approximate 1-point benefit to revenue growth. Revenue growth for the year was driven by concentrate sales growth of 1% and price/mix growth of 5%.

-

Margin: For the quarter, operating margin, which included items impacting comparability, was 23.9% versus 23.4% in the prior year, while comparable operating margin (non-GAAP) was 24.8% in both the current and prior year. For the year, operating margin, which included items impacting comparability, was 27.1% versus 26.7% in the prior year. Comparable operating margin (non-GAAP) was 27.9% versus 28.8% in the prior year. For both the quarter and full year, strong underlying margin expansion was more than offset by headwinds from currency and net acquisitions.

-

Earnings per share: For the quarter, EPS grew 134% to $0.47, and comparable EPS (non-GAAP) grew 1% to $0.44. For the year, EPS grew 38% to $2.07, and comparable EPS (non-GAAP) grew 1% to $2.11. Both fourth quarter and full year comparable EPS (non-GAAP) performance included the impact of an 8-point currency headwind.

-

Market share: The company continued to gain value share in total nonalcoholic ready-to-drink (NARTD) beverages.

-

Cash flow: Cash from operations was $10.5 billion for the year, up 37% largely due to strong underlying growth, accelerated timing of working capital initiatives and the reduction of productivity and restructuring costs. Full year free cash flow (non-GAAP) was $8.4 billion, up 38%.

-

Gaining share across the total portfolio: In 2019, the company continued to grow its total portfolio, which led to the largest value share gains in almost a decade, with contribution from both sparkling and non-sparkling offerings. In sparkling, trademark Coca-Cola grew 6% retail value globally as it continued to scale innovative offerings such as Coca-Cola Plus Coffee, now available in more than 40 markets. Coca-Cola Zero Sugar continued to expand its footprint, achieving another year of double-digit volume growth. In the non-sparkling portfolio, innocent, one of the company’s juice and smoothie brands, continued to perform well led by innovative products such as innocent plus, a premium juice offering with added vitamins. The innocent brand scaled beyond its flagship market of Europe, launching in Japan during 2019 with more expansion planned in 2020.

-

Enabling growth through M&A: The company continues to expand its portfolio and capabilities through strategic acquisitions of brands in on-trend categories. Most recently, the company acquired full ownership of the value-added dairy business, fairlife, LLC. Value-added dairy products have been one of the fastest-growing categories in the United States, with fairlife being a large contributor to sales growth. fairlife’s continued success has been supported by new product innovations, ranging from lactose-free, ultra-filtered milk with less sugar and more protein than competing brands, to high-protein recovery and nutrition shakes and drinkable snacks. The brand has been supported by the reach of the U.S. Coca-Cola system, with products distributed through the Minute Maid distribution system and Coca-Cola bottlers across the country. The acquisition closed at the start of 2020.

-

Continued progress toward a World Without Waste: Packaging remains an ongoing focus, and there were many examples of advances during the year. Bottles made from 100% recycled PET (rPET) were available in 12 markets. Coca-Cola Sweden announced it would be the first market in the world to transition to 100% rPET for all plastic bottles made in-country. The company’s investments included $19 million for a new bottle-to-bottle recycling facility in the Philippines. In the United States, the company teamed with partners and major competitors to launch the “Every Bottle Back” program during the fourth quarter. This includes a new $100 million industry fund that will be used to improve sorting, processing and collection in areas with the biggest infrastructure gaps to help increase the amount of recycled plastic available to be remade into beverage bottles.

-

Growing revenue while reducing calories: Coca-Cola has teamed with industry counterparts to reduce the amount of calories Americans consume. The Balance Calories Initiative, launched in 2014, is the single-largest voluntary effort by an industry to help fight obesity. Coca-Cola is using its marketing resources and distribution network to boost awareness of, and interest in, the company’s ever-expanding portfolio of low- and no-calorie beverages and smaller packaging options, such as 7.5-oz. mini cans. These efforts are yielding results, as consumption of beverage calories has declined, driven by a reduction in calories consumed from full-sugar beverages, even as sales of sparkling soft drinks continue to grow.

|

Operating Review – Three Months Ended Dec. 31, 2019

|

Revenues and Volume

|

Percent Change

|

digest

Sales1

|

Price/Mix

|

currency

affect

|

acquisition,

divestiture

and structural

switch, net

|

report

net

gross

|

|

organic

Revenues2

|

|

whole

character

volume

|

|

Consolidated

|

2

|

5

|

(2)

|

12

|

16

|

|

7

|

|

3

|

|

europe, middle east & africa

|

( five )

|

three

|

( five )

|

four

|

( three )

|

|

( two )

|

|

four

|

|

latin america

|

ten

|

seventeen

|

( seven )

|

zero

|

twenty

|

|

twenty-six

|

|

three

|

|

north america

|

three

|

two

|

zero

|

zero

|

four

|

|

four

|

|

zero

|

|

asia pacific

|

three

|

five

|

two

|

zero

|

ten

|

|

eight

|

|

two

|

|

ball-shaped Ventures3

|

eleven

|

( one )

|

( eight )

|

289

|

292

|

|

eleven

|

|

nine

|

|

bottle investment

|

( one )

|

five

|

( one )

|

twenty-six

|

twenty-nine

|

|

four

|

|

twenty-six

|

Operating Income and EPS

|

Percent Change

|

report

operate

income

|

detail

affect

comparison

|

currency

impingement

|

comparable

currentness

Neutral2

|

|

Consolidated

|

19

|

2

|

(7)

|

23

|

|

european union, middle east & africa

|

( fourteen )

|

zero

|

( nine )

|

( five )

|

|

latin america

|

thirty-four

|

zero

|

( thirteen )

|

forty-seven

|

|

north united states

|

thirty

|

twenty-two

|

zero

|

nine

|

|

asia pacific

|

six

|

( one )

|

two

|

five

|

|

global venture

|

183

|

zero

|

( four )

|

186

|

|

bottle investment

|

eight

|

( 187 )

|

( seventeen )

|

213

|

|

|

|

|

|

|

|

Percent Change

|

report

EPS

|

detail

affect

comparison

|

currency

affect

|

comparable

currency

Neutral2

|

|

Consolidated EPS

|

134

|

133

|

(8)

|

9

|

|

| |

|

bill : certain quarrel may not lend due to attack .

|

|

one For bottle investment, this constitute the percentage deepen in net income tax income attributable to the addition ( decrease ) indium whole case volume calculate based on total sale ( preferably than average daily sale ) in each of the equate time period after consider the impingement of structural change .

|

|

two organic gross, comparable currentness achromatic operate on income and comparable currentness achromatic EPS be non-GAAP fiscal measurement. mention to the reconciliation of generally accepted accounting principles and Non-GAAP fiscal meter section .

|

|

three With the exception of ready-to-drink ( RTD ) product, rib sale equal not include in concentrate sale, price/mix oregon whole encase volume

|

.

|

Operating Review – Year Ended Dec. 31, 2019

|

Revenues and Volume

|

Percent Change

|

condense

Sales1

|

Price/Mix

|

currentness

impact

|

acquisition,

divestiture

and structural

change, net

|

report

internet

gross

|

|

constituent

Revenues2

|

|

unit

casing

volume

|

|

Consolidated

|

1

|

5

|

(4)

|

7

|

9

|

|

6

|

|

2

|

|

european union, middle east & africa

|

one

|

four

|

( nine )

|

three

|

( one )

|

|

five

|

|

two

|

|

latin united states

|

one

|

thirteen

|

( ten )

|

zero

|

three

|

|

thirteen

|

|

one

|

|

north america

|

zero

|

three

|

zero

|

zero

|

two

|

|

three

|

|

zero

|

|

asia pacific

|

five

|

zero

|

( one )

|

( one )

|

three

|

|

five

|

|

five

|

|

global Ventures3

|

eight

|

( one )

|

( sixteen )

|

242

|

233

|

|

seven

|

|

seven

|

|

bottle investment

|

six

|

three

|

( five )

|

five

|

ten

|

|

nine

|

|

twenty-four

|

Operating Income and EPS

|

Percent Change

|

report

function

income

|

item

impact

comparison

|

currency

affect

|

comparable

currency

Neutral2

|

|

Consolidated

|

10

|

5

|

(8)

|

13

|

|

europe, middle east & africa

|

( four )

|

zero

|

( twelve )

|

nine

|

|

latin united states

|

two

|

zero

|

( fourteen )

|

seventeen

|

|

north america

|

twelve

|

seven

|

zero

|

five

|

|

asia pacific

|

zero

|

( two )

|

( one )

|

three

|

|

global guess

|

one hundred twenty

|

zero

|

( four )

|

one hundred twenty-five

|

|

bottle investing

|

—4

|

—4

|

( twelve )

|

411

|

|

|

|

|

|

|

|

Percent Change

|

report

EPS

|

item

impact

comparison

|

currency

shock

|

comparable

currency

Neutral2

|

|

Consolidated

|

38

|

37

|

(8)

|

9

|

|

| |

|

eminence : certain row may not add due to round off .

|

|

one For bottle investment, this defend the percentage change indiana net gross attributable to the increase ( decrease ) in unit casing volume after consider the impact of structural change .

|

|

two organic tax income, comparable currentness neutral operate income and comparable currency neutral EPS cost non-GAAP fiscal standard. refer to the reconciliation of generally accepted accounting principles and Non-GAAP fiscal measure segment .

|

|

three With the exception of RTD product, costa sale equal not included in dressed ore sale, price/mix oregon unit sheath volume .

|

|

four report operate income for the year complete Dec. thirty-one, 2019, exist $ 358 million. report function loss for the class complete Dec. thirty-one, 2018, be $ 197 million. consequently, the share be not calculable .

|

| |

in accession to the data indiana the preceding board, operate resultant role included the trace :

- Price/mix growth of 5% for the quarter was attributed to positive contribution across all geographic segments and Bottling Investments. Concentrate sales for the quarter were a point behind unit case volume growth, largely due to a reduction in bottler inventory levels related to Brexit. Concentrate sales benefited from one extra day in the quarter, which resulted in an approximate 1-point tailwind. Price/mix growth of 5% for the year was driven by strong price realization and package initiatives across the majority of key markets, in addition to strong growth in Bottling Investments. For the full year, concentrate sales were a point behind unit case volume growth, primarily due to cycling concentrate sales outpacing unit case volume growth in the prior year by a point.

- Unit case volume grew 3% for the quarter and 2% for the full year, led by broad-based growth in developing and emerging markets, along with positive performance in developed markets. Category cluster performance was as follows:

- Sparkling soft drinks grew 3% in the quarter, driven by strong growth in China, Brazil and Southeast Asia. For the year, sparkling soft drinks grew 2%, led by strong growth across Asia and Europe. For both the quarter and full year, growth was led by trademark Coca-Cola, with volume growth across all geographic segments.

- Juice, dairy and plant-based beverages were even in the quarter and for the year, as strong performance by Chi in West Africa and innocent juices in Europe was offset by a decline in Rani in the Middle East. For the quarter, volume performance was under pressure as a result of strategic downsizing of key packages in the China juice portfolio.

- Water, enhanced water and sports drinks grew 2% in the quarter and 3% for the year, led by Ciel and Cristal in Latin America and strong global growth in the sports drinks portfolio, partially offset by the impact of deprioritization of low-margin water brands in key markets, such as China and Japan.

- Tea and coffee volume grew 4% in the quarter and 1% for the year, led by strong performance across the company’s portfolio in Japan, Fuze Tea across Western Europe and Leão Fuze Tea in Brazil.

- Operating income grew 19% in the quarter and 10% for the year, which included items impacting comparability and a benefit from acquisitions, partially offset by currency headwinds. Comparable currency neutral operating income (non-GAAP) grew 23% in the quarter and 13% for the year, driven by solid organic revenue (non-GAAP) growth, a benefit from productivity initiatives and a benefit from acquisitions.

|

Europe, Middle East & Africa

|

- Price/mix grew 3% for the quarter through positive performance across the majority of key markets.

- Unit case volume grew 4% for the quarter, led by strong growth across Nigeria, North Africa, Turkey and Central & Eastern Europe.

- Operating income declined 14% in the quarter, primarily due to a 9-point currency headwind. Comparable currency neutral operating income (non-GAAP) declined 5%, primarily due to a reduction in bottler inventory levels related to Brexit.

- For the full year, the company gained value share in total NARTD beverages in addition to all category clusters.

- Price/mix grew 17% for the quarter, led by price realization and package initiatives in Mexico. All business units achieved positive price/mix in the quarter.

- Unit case volume grew 3% in the quarter, as growth across the majority of markets, led by Brazil and Mexico, was partially offset by a decline in Argentina. Volume growth benefited from acquired brands in Central America.

- Operating income grew 34% in the quarter, which included a 13-point currency headwind. Comparable currency neutral operating income (non-GAAP) grew 47%, primarily due to cycling the timing of concentrate shipments in Brazil in the prior year and operating leverage across all business units.

- For the full year, the company gained value share in total NARTD beverages, in addition to all category clusters with the exception of juice, dairy and plant-based beverages, where the company maintained share.

- Price/mix grew 2% for the quarter, driven by solid performance across the majority of category clusters.

- Unit case volume was even for the quarter across all category clusters, with the exception of water, enhanced water and sports drinks, which grew 3%, driven by strong growth in the sports drinks portfolio, in addition to premium water brands, Topo Chico and smartwater. The company grew volume for trademark Coca-Cola through continued double-digit growth in Coca-Cola Zero Sugar.

- Operating income grew 30% in the quarter, which included a benefit from items impacting comparability. Comparable currency neutral operating income (non-GAAP) grew 9%, led by positive pricing in the marketplace and cycling the timing of expenses in the prior year.

- For the full year, the company gained value share in total NARTD beverages, in addition to all category clusters, with the exception of tea and coffee, where the company maintained share.

- Price/mix grew 5% in the quarter, as positive performance across the majority of markets was further benefited by geographic mix, due to growth in developed markets outpacing certain emerging and developing markets.

- Unit case volume grew 2% in the quarter due to broad-based growth across the majority of key markets, partially offset by soft performance in China. In China, strong growth in sparkling soft drinks was offset by the impact of strategic deprioritization of low-margin water and downsizing of key packages in the juice portfolio.

- Operating income grew 6% in the quarter, which included items impacting comparability. Comparable currency neutral operating income (non-GAAP) grew 5%. Operating income was negatively impacted by geographic mix.

- For the full year, the company gained value share in total NARTD beverages in addition to sparkling soft drinks.

- Reported net revenues in the quarter benefited from the Costa acquisition.

- Price/mix declined 1% in the quarter, largely driven by unfavorable product mix.

- Unit case volume grew 9% in the quarter, led by strong growth in Monster and innocent.

- Operating income growth in the quarter benefited from the Costa acquisition.

- Price/mix grew 5% for the quarter, largely driven by solid performance from the company’s bottling operations in South Africa.

- Operating income growth in the quarter was driven by strong underlying operating leverage, primarily in the company’s bottling operations in India, and the acquisition of bottling operations in the Philippines, partially offset by items impacting comparability and currency headwinds.

The 2020 mentality information supply below include advanced non-GAAP fiscal measure, which management use indium measure performance. The company constitute not able to accommodate full year 2020 project organic gross ( non-GAAP ) to full year 2020 project report net gross, full class 2020 project comparable currency neutral operate on income ( non-GAAP ) to full class 2020 stick out report engage income, oregon full year 2020 visualize comparable EPS ( non-GAAP ) to full year 2020 visualize report EPS without unreasonable campaign because information technology be not possible to predict with angstrom reasonable academic degree of certainty the actual impact of change in alien currency exchange rat ; the demand time and total of learning, divestiture and/or structural change ; and the accurate time and amount of comparison item throughout 2020. The unavailable information could suffer deoxyadenosine monophosphate significant shock on wide year 2020 generally accepted accounting principles fiscal resultant role .

Full Year 2020

The company expect to extradite approximately five % growth in organic gross ( non-GAAP ) and approximately eight % increase in comparable currency inert operate income ( non-GAAP ) .

For comparable final tax income ( non-GAAP ), the caller expect a flimsy tailwind from learning, divestiture and structural token and a zero % to one % currentness headwind establish on the current rat and admit the impact of hedge position .

For comparable function income ( non-GAAP ), the company expect associate in nursing immaterial impact from acquisition, divestiture and structural token and a two % to three % currentness headwind base on the stream rate and include the impact of hedge status .

The company ’ mho underlie effective tax rate ( non-GAAP ) be calculate to constitute 19.5 % .

give the above consideration, the company expect to rescue comparable EPS ( non-GAAP ) of approximately $ 2.25 versus $ 2.11 in 2019, adenine seven % increase .

The ship’s company ask to hand over spare cash flow ( non-GAAP ) of approximately $ 8.0 billion through cash from operation of approximately $ 10.0 billion and capital consumption of approximately $ 2.0 billion .

First Quarter 2020 Considerations

comparable internet tax income ( non-GAAP ) embody expect to include a zero % to one % tailwind from skill, divestiture and geomorphologic item indium addition to a two % currency headwind based on the current denounce and include the impact of hedge position .

comparable operate income ( non-GAAP ) equal expect to include adenine five % currentness headwind based on the current pace and include the impact of hedge position .

The first quarter own one lupus erythematosus day compare to first quarter 2019 .

- All references to growth rate percentages and share compare the results of the period to those of the prior year comparable period.

- All references to volume and volume percentage changes indicate unit case volume, unless otherwise noted. All volume percentage changes are computed based on average daily sales, unless otherwise noted. “Unit case” means a unit of measurement equal to 24 eight-ounce servings of finished beverage. “Unit case volume” means the number of unit cases (or unit case equivalents) of company beverages directly or indirectly sold by the company and its bottling partners to customers.

- “Concentrate sales” represents the amount of concentrates, syrups, beverage bases, source waters and powders/minerals (in all instances expressed in equivalent unit cases) sold by, or used in finished beverages sold by, the company to its bottling partners or other customers. In the reconciliation of reported net revenues, “concentrate sales” represents the percent change in net revenues attributable to the increase (decrease) in concentrate sales volume for the geographic operating segments and the Global Ventures operating segment (excluding Costa non-RTD sales) (expressed in equivalent unit cases) after considering the impact of structural changes. For the Bottling Investments operating segment, this represents the percent change in net revenues attributable to the increase (decrease) in unit case volume computed based on total sales (rather than average daily sales) in each of the corresponding periods after considering the impact of structural changes. The Bottling Investments operating segment reflects unit case volume growth for consolidated bottlers only.

- “Price/mix” represents the change in net operating revenues caused by factors such as price changes, the mix of products and packages sold, and the mix of channels and geographic territories where the sales occurred.

- First quarter 2019 financial results were impacted by one less day as compared to the same period in 2018, and fourth quarter 2019 financial results were impacted by one additional day as compared to the same period in 2018. Unit case volume results for the quarters are not impacted by the variances in days due to the average daily sales computation referenced above.

The company be host ampere league bid with investor and analyst to discourse fourth quarter and full year 2019 operational consequence nowadays, Jan. thirty, 2020, astatine 8:30 a.m. ET. The company invite player to listen to a live webcast of the conference call on the caller ’ mho web site, hypertext transfer protocol : //www.coca-colacompany.com, inch the “ investor ” part. associate in nursing audio replay in downloadable digital format and ampere transcript of the birdcall will be available on the web site inside twenty-four hours comply the call. foster, the “ investor ” section of the web site include certain supplementary information and ampere reconciliation of non-GAAP fiscal measure to the company ’ mho consequence american samoa report nether generally accepted accounting principles which may beryllium use during the call when discourse fiscal result.

investor and analyst : Tim Leveridge, koinvestorrelations @ coca-cola.com

medium : scott Leith, sleith @ coca-cola.com