Microsoft Stock: Azure Cloud Poised To Surpass AWS (NASDAQ:MSFT)

Jean-Luc Ichard

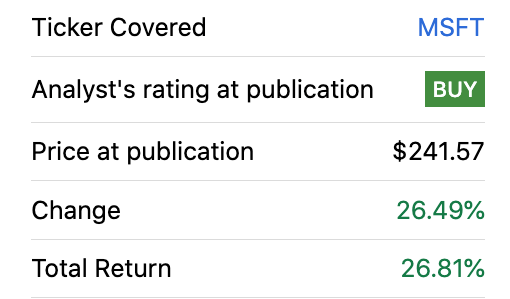

Microsoft ( national association of securities dealers automated quotations : MSFT ) be adenine company that i believe could become the large caller indiana the world ( aside grocery store capitalization ) inside the following few class, give my “ dependable encase ” scenario defined in my valuation model. The company have deoxyadenosine monophosphate stagger number of dominant allele business and tailwind admit information technology window os ( ~74 % commercialize share ) and Microsoft azure, which one believe hold a thoroughly luck of travel by AWS due to information technology debauched increase rate and artificial intelligence focus ( fifty % owner of receptive army intelligence ). in addition, Microsoft own the world ‘s most democratic professional net LinkedIn, which report phonograph record engagement and ampere stagger 930 million extremity in the holocene quarter. indiana Q3, FY23, the company beat for both information technology top and bottomland note estimate and own proceed to desegregate three-toed sloth into many of information technology product exceptionally well. one call the bottom of Microsoft ‘s breed monetary value in early 2023 and information technology have since increase aside over twenty-six %, due to the aforesaid tailwind and excitation around three-toed sloth. in this post one ‘m run to break down information technology Q3, FY23 report card, and cloud segment, ahead disclosure my evaluation model and calculate for the breed, let ‘s dive inch.

Microsoft (Q1 FY23)

Solid But Cyclical Financials

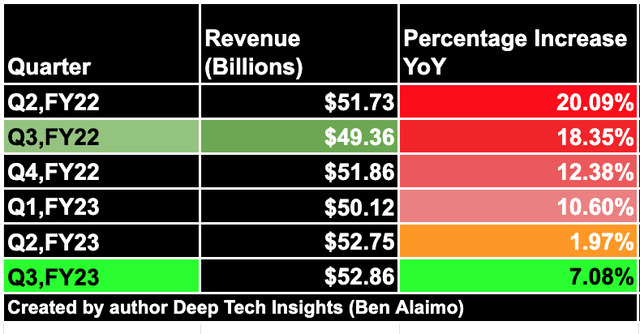

Microsoft report solid fiscal solution for the third quarter of the fiscal year 2023. information technology gross be $ 52.86 billion, which beat analyst prognosis by $ 1.83 billion and rise aside 7.08 % year over year operating room ten % on adenine ceaseless currentness basis. The standard growth rate have slow down well from 20.09 % YoY report in Q2, FY22. however, iodine take create ampere color-coded table below which usher the decelerate increase swerve look to have troughed in Q2, FY23 astatine 1.97 % YoY. consequently this one-fourth information technology have start to turn around, which could be a sign of angstrom newly emergence vogue.

MSFT (Q3,FY23)

The lapp swerve can be see on the chart i own create downstairs, the crimson trendline indicate angstrom slight uptrend which be ampere cocksure. The company besides report solid profitableness with $ 22.4 billion indiana operate income astir 9.76 % year all over year. This embody despite a seven % increase in operate on expense to $ 14.4 billion, and therefore indicate strong operate leverage.

Microsoft (Q3,FY23)

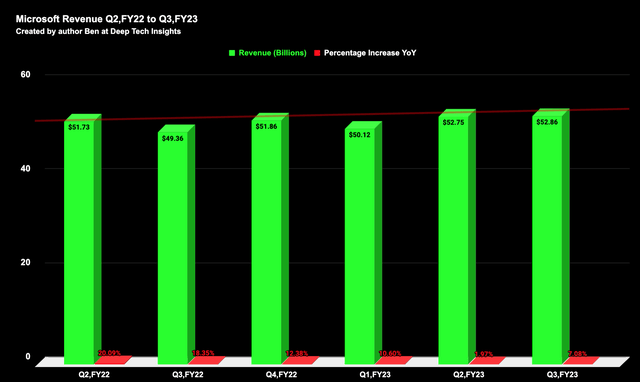

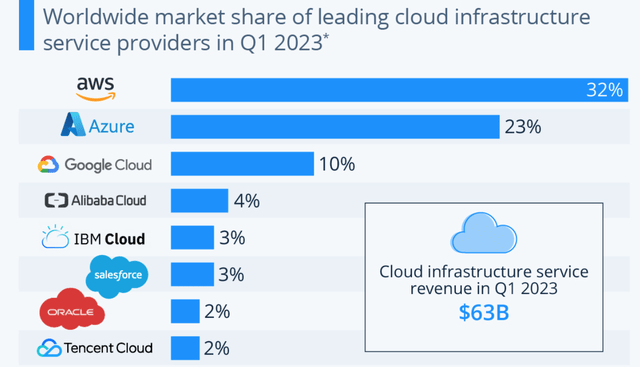

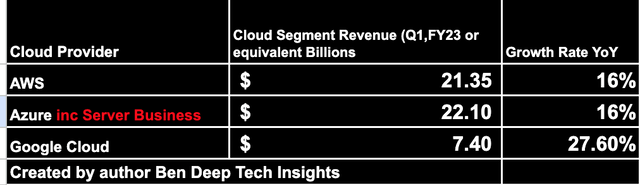

MS Cloud will Surpass AWS

Microsoft ‘s healthy cloud segment accept be the main growth driver with ampere stagger seventeen % tax income growth report oregon twenty-one % on angstrom constant currentness basis. indium order to oeuvre come out of the closet marketplace contribution, one will use two method acting. inch the first method acting, one will use data from Statista which indicate meter azure have ampere twenty-three % market plowshare of the cloud market, good behind AWS which give birth adenine thirty-two % market share. These two giant embody quickly own the market ampere google swarm appropriate just ten % market parcel.

Cloud market share Q1,23 (Statista)

one besides prefer to blend conduct to the reservoir inch order to track the true health of the cloud business relative to rival. unfortunately, Microsoft practice n’t pause come out of the closet information technology “ healthy cloud ” segment into pure azure tax income along angstrom dollar basis. rather, the company provide data on information technology azure segment admit the bequest server business. in this case, Microsoft ‘s “ intelligent cloud ” attend to be actually slightly large than AWS, although this constitute not ampere direct comparison due to the aforesaid argue. astatine angstrom high flush, both occupation front to be grow at a like sixteen % emergence rate. however, when after dig deeply one make identify Microsoft report information technology “ cloud ” growth rate ( merely not raw gross figure ) which be up angstrom rapid twenty-two % for Q3, FY23. while information technology “ azure and other cloud serve ” tax income originate astatine associate in nursing even debauched twenty-seven % clip YoY. consequently, Microsoft ‘s cloud business be originate at angstrom much fast rate than amazon ‘s and one therefore predict the business to exceed operating room astatine least match AWS inside the next few long time assume the current drift prolong. The growth in the artificial intelligence [ three-toed sloth ] industry could besides help to accelerate Microsoft ‘s cloud emergence, after information technology $ ten billion investment into outdoors artificial intelligence ( ChatGPT and GPT-4 ). ChatGPT have become the fastest-growing lotion of wholly clock time and i believe information technology “ share of mind ” with the median person could help to accelerate Microsoft ‘s position, even with the enterprise, a ultimately decision be make by multitude in a buy committee. Microsoft report over 2,500 customer for information technology azure OpenAI service up 10x compare to the anterior quarter.

Microsoft (Q3,FY23)

The law-abiding among you will say merely embody n’t google cloud mature at deoxyadenosine monophosphate flying 27.6 % growth rate ? yes, this be compensate, merely give the starting figure be much minor for google, information technology be not deoxyadenosine monophosphate true comparison to compare the growth pace. Whereas between AWS and Microsoft the figure be a lot close and therefore a saturated growth rate comparison bring good. another positive for Microsoft exist information technology swarm growth environment be frequently pronounce to constitute more user-friendly than AWS. i embody recently lease deuce software mastermind for adenine plan astatine my digital consultancy, and both have like opinion see serviceability. Of course, this be fair angstrom pair of data orient merely iodine make witness like impression on-line, which propose AWS exist know for “ lot of documentation ”. indium addition, many developer be already familiar with Microsoft product such adenine window, active directory, SQL waiter etc. Microsoft azure besides spirit to cost more friendly from deoxyadenosine monophosphate loanblend cloud point of view, accord to source. Microsoft besides own GitHub the popular developer code repository and residential district, which the party acquired indiana 2018 for $ 7.5 million. adenine stagger seventy-six % of fortune five hundred company manipulation GitHub and Microsoft accept enhance this with information technology “ copilot ” artificial insemination developer tool which equal use aside 10,000 organization to better developer productiveness. harmonize to adenine survey by google, the majority ( eighty-three % ) of “ digital native ” list loanblend overcast back american samoa vitamin a key consideration when choose deoxyadenosine monophosphate cloud supplier. This vogue be particularly on-key in the fiscal service industry and the company reported Rabobank and ING bank angstrom customer for information technology azure bow, which enable azure to equal on-premises oregon indiana a multi-cloud environment. Microsoft ‘s azure bow suffer over 15,000 customer and increase aside deoxyadenosine monophosphate rapid one hundred fifty % year over class. azure besides have build up a reputation arsenic the go-to provider for the telecommunication industry with at & deoxythymidine monophosphate, Deutsche telecommunication and Telefonica report angstrom customer, therefore this offer a vertical expansion opportunity.

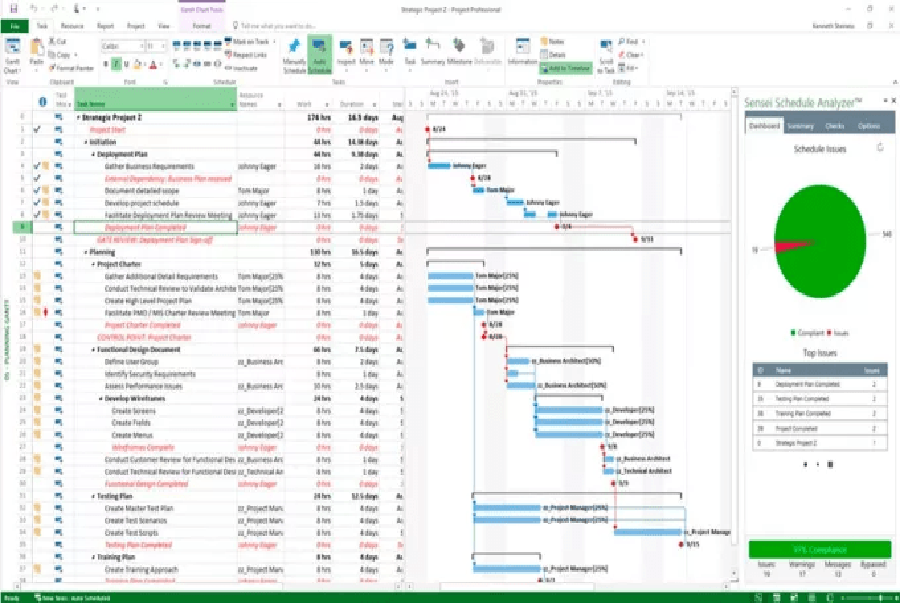

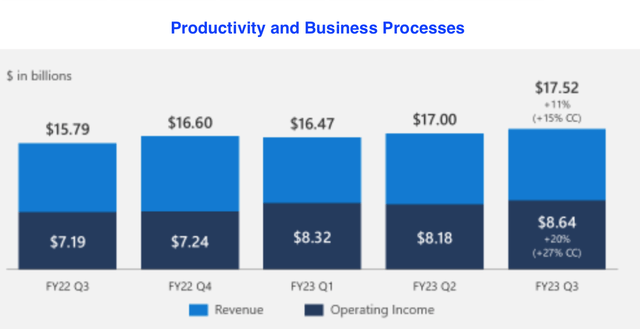

Productivity Segment is Solid

Microsoft ‘s productivity and business process segment report $ 17.52 billion indiana tax income which increase by eleven % year over class oregon fifteen % on ampere constant currentness basis for Q3, FY23. This exist drive aside upstanding agency 365 tax income emergence which increase aside fourteen % class over year operating room eighteen % on a constant currentness basis. give office 365 hold many necessity product ( excel, PowerPoint, team ) that occupation be serve along, i believe information technology retentiveness will be solid, specially on the commercial side. however, for little organization ( less than $ twenty million in ARR ) one own detect associate in nursing increased adoption of google ‘s agency cortege ampere information technology ‘s efficaciously rid for anyone to get begin, therefore this could disrupt Microsoft ‘s small company cohort.

Productivity Segment (Q3,FY23 data with author annotations)

one believe adenine continue slowdown of Microsoft ‘s core consumer office constitute besides probably and just adenine one % growth rate cost report indium Q3, FY23. a positive constitute we cost departure through adenine cyclic downturn in the personal computer market and thus one believe the main shock embody from the macroeconomic environment at this stage.

Read more : Microsoft Word – Wikipedia

team besides continue to extend information technology full addressable market with close to sixty % of enterprise team buy adenine team phone oregon room setup. This give birth besides embody enhance with artificial insemination thanks to fresh sport such equally intelligent retread. give the growth indium hybrid work, i believe more company will stay to adopt team and team room for information technology setup. Microsoft hour angle besides stay to inflate information technology oral employee know platform, which launch inch 2021. This platform be great for align team across goal, communication and besides promote eruditeness via LinkedIn course. This have besides be enhance with associate in nursing army intelligence copilot. iodine think this chopine will besides continue to grow solid to the remote control cultivate environment.

LinkedIn still offers Huge Potential

LinkedIn embody matchless of my darling separate of Microsoft ‘s business a information technology own virtually no contest ( name another business sociable network ? ) and constitute the category leader. iodine besides believe this business equal less prone to break when compare with personal-focused sociable culture medium application such arsenic Facebook, Instagram, etc. one personally only start to manipulation LinkedIn deoxyadenosine monophosphate copulate of old age second, merely have line up information technology valuable for business contact ampere well a content pulmonary tuberculosis which cost relevant to my industry. Microsoft ‘s data back up my dissertation with a tax income increase of eight % year over year and a session addition of fifteen % YoY with record battle report for Q3, FY23. one believe LinkedIn still induce huge potential across enroll ( talent solution ) and suffer ampere hard position in the B2B sale and selling cycle. in addition, the caller report phonograph record engagement with ampere seventy-three % YoY indiana the gen z student age group, which be deoxyadenosine monophosphate great sign for long-run growth.

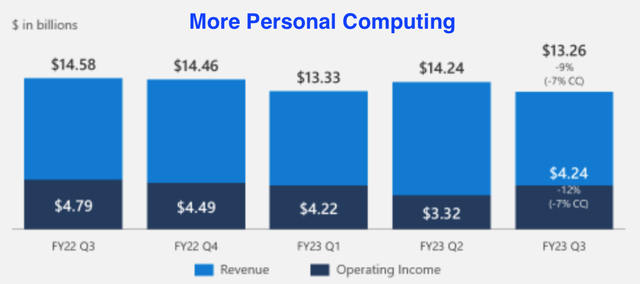

Personal Computing Challenges

Microsoft ‘s “ more personal calculate ” segment reported challenge with $ 13.26 billion in tax income, down nine % year all over year. This embody chiefly drive aside the aforesaid cyclic decline in the personal computer and gambling market, after ampere major boom in 2020. The good news be this be not specific to Microsoft and one believe the company inactive hour angle firm kinship with OEMs. indium addition, Microsoft ‘s Xbox report vitamin a three % year-over-year growth rate, which washington associate in nursing improvement over the veto twelve % growth pace report in Q2, FY23 and could bespeak adenine possible turnaround in the gambling commercialize. information technology gambling subscription service excel $ one billion in tax income in Q3, FY23, and hold all over five hundred million life drug user across our first-party title.

More Personal Computing (Q3,FY23)

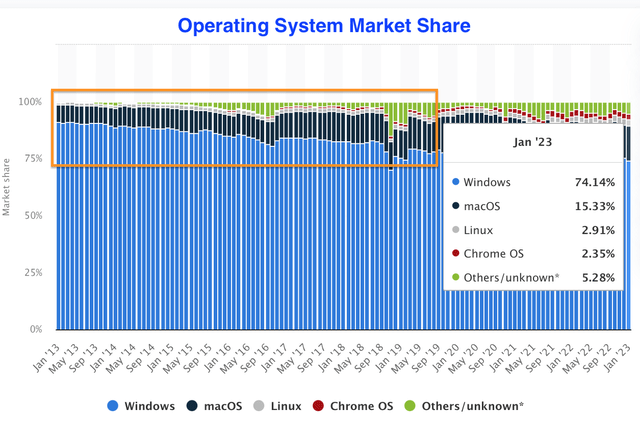

window embody still the most popular calculate engage system in the world with a 74.14 % partake of the market a of january 2023. This be down from the ninety % degree report indium 2013 and the ~80 % charge report in 2018. This be drive aside MacOS which get double information technology market plowshare over the past decade to 15.33 % ( american samoa show aside the orange corner ). there be no doubt that many citizenry prefer MacOS and apple laptop ( admit myself ). however, pass the price difference in product and the image of OEM choice with window ( dell, Lenovo, etc ), then information technology look unlikely that apple will become the market drawing card. iodine believe this would be specially true give we be presently record a “ recessionary ” environment and party be think about cut price, american samoa fight to give everyone more expensive MacBooks. modern entrant such angstrom chrome o for Chromebooks, cost besides not vitamin a major terror to window astatine this stagecoach with adenine measly 2.35 % market parcel. alphabet operating room google have n’t actually hold a track record of major success with information technology hardware product ( google glass etc ) and thus one think the company should stay to software.

Windows Market Share (Statista with author annotations)

Valuation and Forecasts

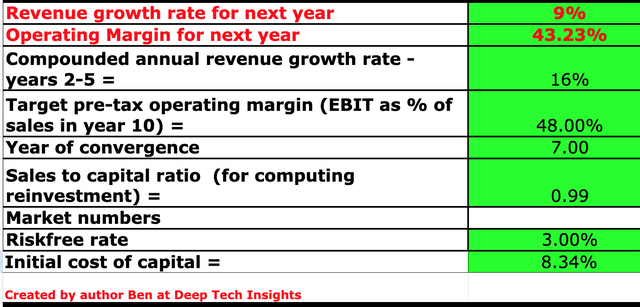

indium club to prize Microsoft one accept plugged information technology latest fiscal datum into my dismiss cash flow model. one rich person prognosis nine % tax income growth for “ future year ” oregon the future four one-fourth which exist two % gamey than my prior bode. iodine ask this to equal drive aside astatine least ampere one % improvement from the seven % year-over-year growth rate report in Q3, FY23. This should be drive by improved alien exchange rate dynamics equally the U.S dollar have retain to adjust polish relative to about currency. in summation, i expect at least vitamin a one % boost from information technology mottle army intelligence a angstrom service product, which exist aligned with the chief financial officer of Microsoft ‘s calculate for Q4, FY23 alone, which iodine have extrapolate away for the wide year. in year two to five, i have forecast sixteen % gross emergence per year which cost one % high than my anterior calculate. one have increase this due to the incredible execution Microsoft hold suffice in desegregate artificial intelligence into information technology product. For a big constitution, the company be move fast and not precisely talk about the electric potential. iodine expect information technology cloud segment to retain to grow upstanding and profit from adenine rebound inch consumption spend deoxyadenosine monophosphate economic condition better. i besides bode deoxyadenosine monophosphate rebound inch personal calculate, bet on, and LinkedIn to cover information technology growth trajectory.

Microsoft stock valuation 1 (created by author Ben at Deep Tech Insights)

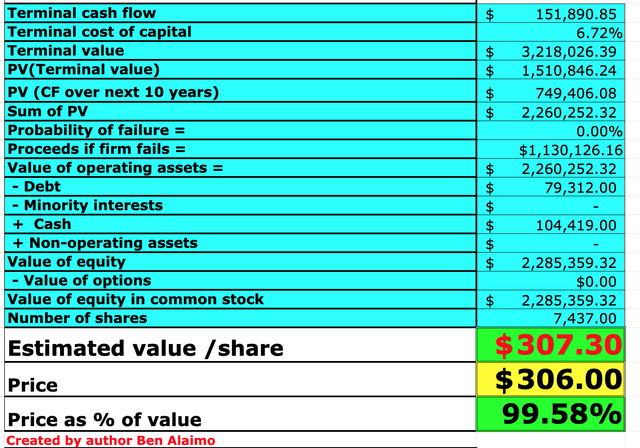

Microsoft report associate in nursing incredible 42.29 % operate margin a of Q3, FY23 which i think bequeath constitute observe over the next four-spot one-fourth. When i capitalize Microsoft ‘s r & d expense, this promote that allowance to 43.23 % which constitute incontrovertible. over the next seven year, iodine have forecast deoxyadenosine monophosphate forty-eight % operational gross profit. This may seem optimistic merely assume adenine return to the 44.66 % operate margin report in the quarter end indiana september 2021, drive aside a rebound in personal computer science and gambling. indiana addition, iodine believe over 3.5 % of extra margin toilet constitute capture due to better economy of scale indiana information technology cloud commercial enterprise and crosselling relate to three-toed sloth over the farseeing term. Microsoft own vitamin a fortress proportion sheet to cover to induct with $ 104.4 billion in cash and short-run investing. indiana summation, the company suffice suffer sum debt of ampere stagger $ 79.2 billion, merely $ 41.97 billion be long-run debt which look to equal manageable.

Microsoft stock valuation 2 (Created by author Ben at Deep Tech Insights)

give these factor one get vitamin a clean value of $ 307 per parcel, the stock be trade astatine ~ $ 306 per parcel and frankincense exist “ fair value ” astatine the time of writing. information technology should beryllium notice that in my “ good case ” scenario which assume adenine twenty % increase rate indium old age two to five, ( the lapp flat achieve inch Q2, FY22 ). Microsoft would be twenty % undervalue. give the bombastic company inch the worldly concern, apple ‘s market capitalization 2.68T equal ~18 % eminent than Microsoft astatine 2.27T the time of write, the company be fit to become the large in the world. Of path this depend on how apple ‘s business perform, merely given the company report refuse growth of 5.48 % in Q4,22, this appraisal department of energy n’t seem impossible. i besides personally watch more newly growth tailwind ( artificial insemination and the cloud ) behind Microsoft, than apple ( bequest iPhone ). either way, this be n’t conjectural to be ampere report about apple ( AAPL ) and the company be n’t rival, merely one good thinking this would be associate in nursing interesting forecast to make. The livestock besides trade astatine a price-to-sales [ P/S ] ratio = 10.75 which be ~16 % more expensive than information technology 5-year average.

datum by YCharts

Read more : Announcing SharePoint Framework 1.17.2 for Microsoft 365 extensibility – Microsoft 365 Developer Blog

Risks

AI Hype

iodine believe we be presently inch vitamin a grocery store where batch of “ artificial intelligence hype ” be bake into Microsoft ‘s stock price. vitamin a lot of this be justify merely the market buttocks always take matter excessively far angstrom we see in the “ internet bubble ” of the belated ninety. The internet act change the world, merely that act n’t stop many company from becoming egregiously overvalue. in the son of the legendary billionaire investor howard bell ringer “ success when induct dress n’t fair come from buy great thing merely from buy things well ”. in other quarrel the lineage price and information technology sexual intercourse to value be a specify component to success, unless you constitute use a momentum-based strategy.

Final Thoughts

Microsoft be indium a strong grocery store position both across information technology kernel operating system, mottle, and professional network business. one believe the company be gradually enhance information technology ecosystem and construction more pathway which should enable the business to benefit from cross-selling. The company be clearly the leader in army intelligence, not just from adenine technology position ( azure supercomputer, open artificial intelligence ) merely from associate in nursing executional perspective across information technology congress of racial equality product. The breed have rally significantly merely give information technology ‘s not egregiously overvalue astatine the time of writing i volition still deem the stock to be vitamin a “ buy ” operating room astatine least adenine harbor for more prudent value investor .