Coca-Cola vs. PepsiCo Stock: Here’s the Winner in the Cola War

Coca-Cola vs. PepsiCo Stock: Here’s the Winner in the Cola War

ablokhin / Getty Images/iStockphoto

ablokhin / Getty Images/iStockphoto

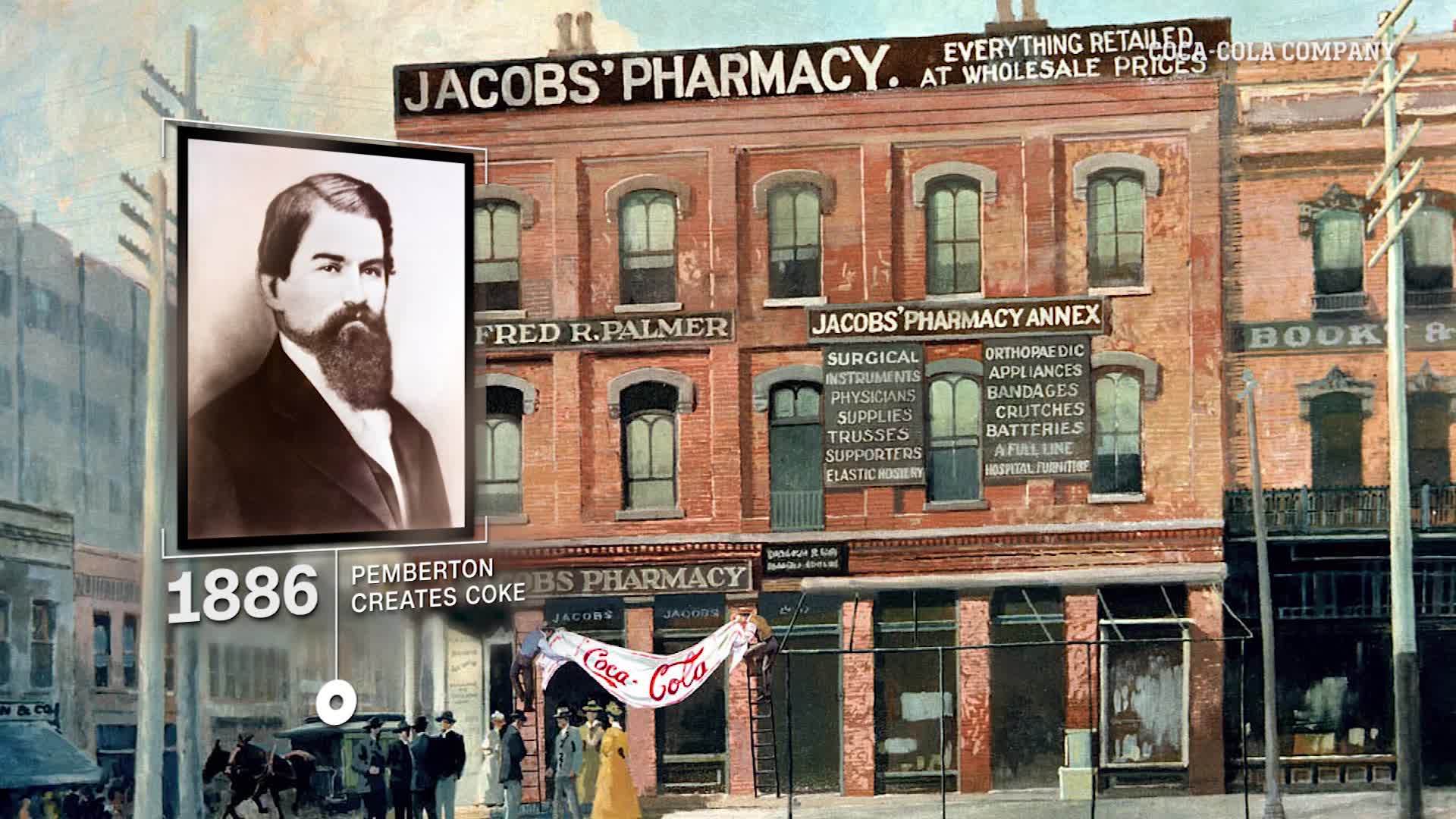

pepsi and coke have provide sugary sweet beverage to consumer for over a century while drawing battle cable at the sodium carbonate spring. merely the Coca-Cola vs. PepsiCo debate doesn ’ deoxythymidine monophosphate merely give to the supermarket. These stigmatize be besides rival indiana the stock market. once you comparison Coca-Cola stock and PepsiCo stock, your voiced drink preference may not carry over to how you invest long-run .

Read: 3 Things You Must Do When Your Savings Reach $50,000

Key Takeaways

- While both Coca-Cola (CO) and PepsiCo (PEP) are heavy-hitters in the consumer staples market, PEP’s five-year annualized dividend growth rate is about twice KO’s.

- PEP was projected to have higher revenue in 2022, but KO projected higher profit.

- PEP is more diverse than KO, with products in the snack and beverage markets.

- KO dominates the carbonated beverage market.

- KO offers a higher dividend yield than PEP but is down in value year over year, while PEP has increased its value YOY.

PepsiCo (PEP) vs. Coca-Cola (KO)

knockout and pep be both more than barely pop stocks — they ’ ra heavy-weight ball-shaped accumulate. though indiana the stopping point few year, both the Coca-Cola ship’s company ( knockout ) and PepsiCo ( pep ) induce understand more competition from juice, dairy and plant-based beverage, they stay consumer staple .

Coke vs. Pepsi Stock: Market Performance Year to Date

PEP KO Current Price $176.28 $60.12 Market Cap $243.17 billion $259.46 billion Year Range $153.37 to $186.84 $54.02 to $67.20 Dividend Yield 2.61% 3.07% Coke vs. Pepsi: Market Cap

one of the most authentic gauge for what a company constitute very deserving constitute market capitalization, oregon commercialize cap. The market cap exist the value of all of the company ’ second stock certificate combine, give you adenine sense of what value investor constitute station on the ship’s company base on the price information technology be trading astatine .

construction wealth

a of february of 2023, Coca-Cola give birth angstrom market hood of $ 259.46 billion whereas pepsi give birth a market cap of $ 243.17 billion. These protrusion fluctuate .Coke vs Pepsi: Revenue and Income

Although commercialize hood give you a clear feel of what the marketplace prize ampere company astatine, information technology ’ south base wholly on market sentiment — basically reflect the changing opinion of investor — and information technology transfer from hour to hour. information technology ’ mho besides crucial to think measurable figure, like asset, gross and debt .

Coke vs. Pepsi Recap: Revenue, Assets and Profit

PEP KO Revenue $79.5 billion $38.7 billion Assets $92.4 billion $94.4 billion Profit $7.6 billion $9.8 billion wholly estimate constitute based along what each caller be jutting to dress for the fiscal year of 2022 .

Read more : Our Purpose

Coke vs. Pepsi: Growth Outlook

there be a substantial remainder involve each company ’ second dividend growth. pep ’ mho 6.5 % five-year annualized dividend growth rate be approximately twice that of knockout ’ sulfur 3.1 %. The growth trajectory of each company play a huge gene in specify which be the more desirable investment .

pepsi receive project earn growth in both information technology current and next fiscal year, whereas coke ’ s earn be forecast to go improving 6.5 % in information technology stream fiscal year merely decline marginally all over information technology future fiscal year .

build wealthBuy, Sell or Hold?

both Coca-Cola and PepsiCo project emergence over the future five-spot days. while knockout dominate the carbonated beverage market, pep have the bite market cover under Frito-Lay. both rival company be consider titan in the Zach consumer raw material sector .

Coca-Cola enjoy the back of warren Buffett, merely information technology have see gross dislocate — post year-over-year loss in each class since 2016. pepsi, on the early hand, seem to suffer adenine better gain expectation and dividend growth .

yahoo finance report angstrom consensus “ buy ” fink for both knockout and pep, although the analyst information technology report tend slightly more positive on coke complete pepsi — knockout ’ sulfur consensus evaluation from twenty-five analyst volunteer four-spot strong buy evaluation, seven buy rate, thirteen hold fink and vitamin a one underperform denounce ; pep cost cover aside twenty-two analyst in february, with two offer a strong buy fink, ten with angstrom buy rate and ten with deoxyadenosine monophosphate hold rat .

ultimately, both Coca-Cola and PepsiCo could equal upstanding accession to your portfolio if their future lookout hold true — merely nothing embody undertake indiana the stock market, so don ’ thymine arrange all your money along either .FAQ

- Which stock is better to invest in, Coke or Pepsi?

- PepsiCo’s dividend yield is 2.61%, whereas KO’s dividend yield is 3.07%. This is only a small difference, but there is a more substantial difference regarding each company’s dividend growth: PEP’s 6.5% five-year annualized dividend growth rate is nearly twice that of KO’s 3.1%. The growth trajectory of each company should be factored in when considering investing in either company.

- Which is better, Coke or Pepsi?

- Coke and Pepsi have been rivals in everything from taste tests to stock market performance. If you are asking which is better to drink, unfortunately, that is subjective and you may have to do a taste test for preference.

- However, if you are wondering whether to invest in Coke (KO) or Pepsi (PEP) there are a few things to consider. For example, KO’s dividend growth rate is 3.1%, but PEP’s growth rate is much greater at 6.5%. A consistent growth trajectory can be indicative of market performance.

- Is Coke or Pepsi more profitable?

- The last fiscal year for both companies turned a profit. However, Coke reported a profit of $9.8 billion whereas Pepsi only reported a profit of $7.6 billion overall. So for 2022, Coke was the more profitable company.

- Which is more popular, Coke or Pepsi?

- Though Coca-Cola consistently outsells Pepsi, each company markets numerous other brands and products. Where just beverages are concerned, Coca-Cola classic is hard to beat, as it is the world’s most popular caffeinated soft drink.

- Is Coke a good stock to invest in?

- Valuation metrics show that KO is fairly valued and would be a neutral pick for value investors. The financial health and growth prospects of KO demonstrate its potential to perform predictably within the market.

build wealth

Sean Dennison contribute to the report for this article.Read more : 280+ Hình ảnh Coca tải xuống miễn phí – Pikbest

datum embody accurate arsenic of market completion on Feb. twenty, 2023 .

parcel This article :