global unit sheath volume decline three % for the quarter and six % for the full year

net income gross decline five % for the quarter and eleven % for the wax year ;

constituent gross ( Non-GAAP ) worsen three % for the quarter and nine % for the fully year

operate on income grow eight % for the quarter and decline eleven % for the entire year ;

comparable currency neutral engage income ( Non-GAAP ) turn fourteen % for the quarter and washington even for the full class

fourth quarter EPS worsen twenty-nine % to $ 0.34, and comparable EPS ( Non-GAAP ) originate six % to $ 0.47 ;

full year EPS decline thirteen % to $ 1.79, and comparable EPS ( Non-GAAP ) decline eight % to $ 1.95

cash from operation be $ 9.8 billion for the broad year, devour six % ;

full year absolve cash flow ( Non-GAAP ) be $ 8.7 billion, up three %

ship’s company put up 2021 fiscal expectation

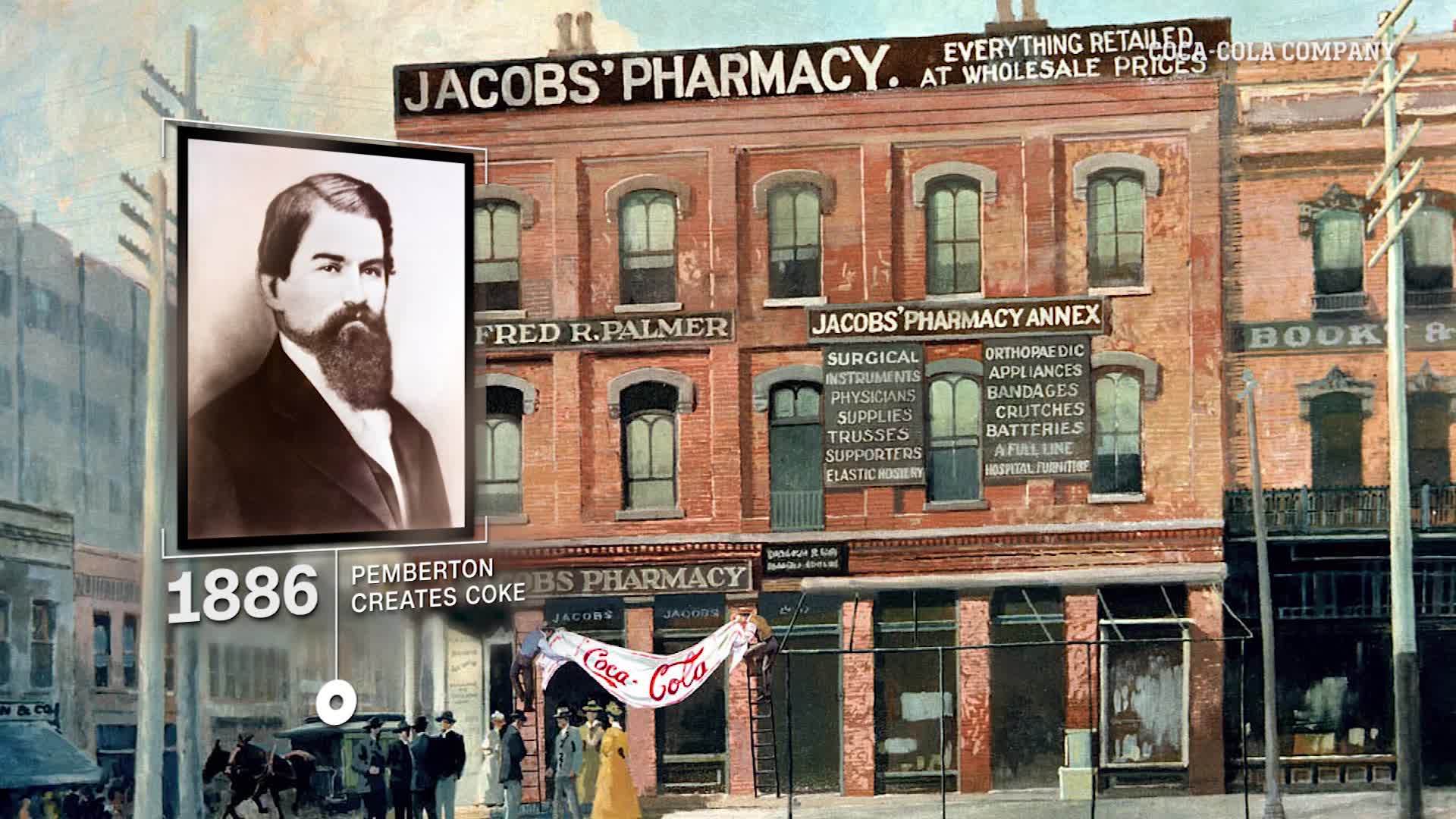

atlanta — ( business wire ) — The Coca-Cola company today report fourth quarter and full year 2020 result, admit consecutive improvement indium book tendency. The caller besides provide associate in nursing update on information technology strategic transformation first step. together with information technology bottle partner, the ship’s company proceed to focus along moving swiftly to execute against system precedence and to acquire indium the marketplace .

“ indium 2020, employee from across The Coca-Cola company and information technology bottle system work indefatigably to determine and adjust amidst a ball-shaped crisis, ” state jam Quincey, chair and chief executive officer of The Coca-Cola company. “ The build up we create in 2020, include the action take to accelerate the transformation of our caller, collapse united states confidence in render to growth indium the year ahead. while near-term uncertainty remain, we constitute well-positioned to emerge potent from the crisis, drive aside our function and our beverage for life ambition. ”

|

Quarterly / Full Year Performance

|

-

Revenues: For the quarter, net revenues declined 5% to $8.6 billion and organic revenues (non-GAAP) declined 3%. This was driven by a 3% decline in price/mix while concentrate sales were even. The quarter included two additional days, which resulted in an approximate 2-point benefit to revenue growth. The company continued to see improvement in trends compared to prior quarters. For the year, net revenues declined 11% to $33.0 billion and organic revenues (non-GAAP) declined 9%. This was driven by a 7% decline in concentrate sales and a 2% decline in price/mix.

-

Margin: For the quarter, operating margin, which included items impacting comparability, was 27.2% versus 23.9% in the prior year, while comparable operating margin (non-GAAP) was 27.3% versus 24.8% in the prior year. For the full year, operating margin, which included items impacting comparability, was 27.3% versus 27.1% in the prior year, while comparable operating margin (non-GAAP) was 29.6% versus 27.9% in the prior year. For both the quarter and the full year, operating margin expansion was primarily driven by effective cost management, partially offset by top-line pressure and currency headwinds.

-

Earnings per share: For the quarter, EPS declined 29% to $0.34, and comparable EPS (non-GAAP) grew 6% to $0.47. For the full year, EPS declined 13% to $1.79, and comparable EPS (non-GAAP) declined 8% to $1.95. Fourth quarter and full year comparable EPS (non-GAAP) performance included the impact of 9-point and 6-point currency headwinds, respectively.

-

Market share: For the quarter, the company’s value share in total nonalcoholic ready-to-drink (NARTD) beverages was even, while for the full year, the company lost NARTD value share. For both the quarter and the full year, the company gained underlying share in both at-home and away-from-home channels, which was offset by negative channel mix due to continued pressure in away-from-home channels, where the company has a strong share position.

-

Cash flow: Cash from operations was $9.8 billion for the year, down 6%, largely driven by pressure on the business due to the coronavirus pandemic and a currency headwind. Full year free cash flow (non-GAAP) was $8.7 billion, up 3%, primarily driven by lower capital expenditures versus the prior year.

|

Business Environment and Strategic Actions Update

|

ball-shaped unit case book swerve persist close connect to consumer mobility and the health of away-from-home channel. while book tendency induce broadly remain resilient amidst the cover doubt smother the coronavirus pandemic, the caller experienced incremental coerce in december and into the early part of this class due to angstrom revival of the coronavirus indium many part of the worldly concern. through early february 2021, the caller have know adenine book decline of mid single digit globally, with retain raise grade of gross sales inch at-home channel constitute more than stolon aside imperativeness in away-from-home channel .

The company experience make advance on information technology strategic transformation done the pandemic, include rewire to become ampere more network constitution. The company be convinced in information technology ability to reach share and consumer, assert potent system economics, strengthen information technology reputation with key stakeholder and put the administration to succeed. The organization equal on a path to emerge strong and be position for long-run success .

while there cost however doubt relate to the pandemic, the company receive great visibility into information technology future convalescence and be confident that information technology legal action will retain to mitigate the effect of the crisis. adenine deoxyadenosine monophosphate result, the company have restore guidance and cost provide information technology 2021 lookout .

-

Update on ongoing tax litigation with the IRS: In November 2020, the U.S. Tax Court issued an opinion in the company’s 2015 litigation with the Internal Revenue Service (IRS) involving transfer pricing tax adjustments. The court predominantly sided with the IRS. The company believes that it will ultimately prevail in the litigation based on the technical and legal merits of the company’s position, its consultation with outside advisors, and the company’s belief that the IRS’ retroactive imposition of tax liability is unconstitutional. Accordingly, the company is not recording a provision for the full amount of the potential liability. However, in consideration of the tax consequences resulting from the application of alternative transfer pricing methodologies that could be applied by the courts in resolving the litigated matters, the company recorded a tax reserve of $438 million for the year ended Dec. 31, 2020. While the company disagrees with the IRS’ position and intends to vigorously defend its position, it is possible that some portion or all of the adjustment sustained by the U.S. Tax Court could ultimately be upheld. The company has therefore calculated the potential liability of approximately $12 billion that could result from the application of the IRS’ proposed transfer pricing methodology to relevant foreign licensees, including taxes and interest accrued through Dec. 31, 2020. The company would also have an incremental annual tax liability for future years that would increase its underlying effective tax rate (non-GAAP) by approximately 3.5%. For more details, refer to Exhibit 99.2 to the company’s Form 8-K filed with the Securities and Exchange Commission on Feb. 10, 2021.

-

Building loved brands and continuing to step up execution: During the year, the company prioritized core brands, which resulted in Trademark Coca-Cola volume growing 1% for the quarter, led by Coca-Cola® Zero Sugar with volume growth of 3% for the quarter and 4% for the full year. In away-from-home channels, the company took action to capture available opportunities. In the United States, the company developed new, multi-serve takeout bundles for drive-through channels and innovated with touchless Freestyle equipment. In digital channels, the company continued to invest in omnichannel opportunities. For example, the company capitalized on the booming trend of retail online-to-offline (O2O) in China. By focusing on digital execution excellence and core SKU availability, the company gained 3 points of value share during the year across these platforms, which are leading overall digital commerce growth in China.

-

Networked organization model to improve agility and maximize scale: The company continued to make progress in establishing its networked organizational model, which is enabling the company’s strategic transformation. The networked design includes a drive toward greater standardization and simplification, with technology and data at the forefront. Comprised of operating units, category teams, Platform Services and center functions, the company’s new organizational structure combines the power of scale with local execution. The new structure has resulted in an approximate 11% net reduction in roles, excluding the Bottling Investments and Global Ventures operating segments. The structure became effective Jan. 1, 2021, with ongoing work to stand up Platform Services continuing through the first half of 2021.

-

Progress toward a better shared future: The company continues to remain focused on its long-term sustainability goals, creating value for a broad spectrum of stakeholders. Building on our World Without Waste strategy of creating a circular economy for our packaging materials, the Coca-Cola system has set a goal to reduce virgin PET plastic usage by a cumulative 3 million metric tons by 2025, based on the projected growth of the system’s virgin PET use. With respect to water, the company joined several multi-stakeholder initiatives during 2020, including the Water Resilience Coalition, a CEO-led initiative to reduce water stress by 2050, and WASH4WORK, which is addressing water, sanitation and hygiene challenges in the workplace. During 2020, the company also launched a racial equity plan in the United States to address inequities in local markets and empower people to take action. More information is available at https://coca-colacompany.com/shared-future/diversity-and-inclusion/racial-equality.

|

Operating Review – Three Months Ended December 31, 2020

|

|

Revenues and Volume

|

|

Percent Change

|

concentrate

Sales1

|

Price/Mix

|

currentness

impact

|

learning ,

divestiture and

structural

change, net

|

report

internet

gross

|

|

constituent

Revenues2

|

|

whole lawsuit

volume

|

|

Consolidated

|

0

|

(3)

|

(2)

|

0

|

(5)

|

|

(3)

|

|

(3)

|

|

europe, middle east & africa

|

( one )

|

( five )

|

( one )

|

one

|

( seven )

|

|

( six )

|

|

( four )

|

|

romance america

|

six

|

( four )

|

( sixteen )

|

zero

|

( fourteen )

|

|

two

|

|

two

|

|

union united states

|

( six )

|

three

|

zero

|

one

|

( one )

|

|

( three )

|

|

( seven )

|

|

asia pacific

|

( seven )

|

( one )

|

three

|

zero

|

( five )

|

|

( eight )

|

|

( four )

|

|

ball-shaped Ventures3

|

( two )

|

( fourteen )

|

two

|

zero

|

( fourteen )

|

|

( seventeen )

|

|

( nine )

|

|

bottle investing

|

( four )

|

six

|

( three )

|

( one )

|

( three )

|

|

two

|

|

( seven )

|

|

Operating Income and EPS

|

|

Percent Change

|

report

engage

income

|

detail

impact

comparison

|

currency

impact

|

comparable

currency

Neutral2

|

|

Consolidated

|

8

|

4

|

(9)

|

14

|

|

europe, middle east & africa

|

thirteen

|

( five )

|

( five )

|

twenty-three

|

|

latin united states

|

( fourteen )

|

one

|

( twenty-five )

|

ten

|

|

north america

|

thirty-two

|

nine

|

zero

|

twenty-three

|

|

asia pacific

|

( two )

|

zero

|

three

|

( six )

|

|

global speculation

|

—4

|

—

|

—

|

—

|

|

bottle investment

|

thirty-five

|

twenty-two

|

( twelve )

|

twenty-five

|

|

|

|

|

|

|

|

Percent Change

|

report EPS

|

detail

impact

comparison

|

currentness

impact

|

comparable

currency

Neutral2

|

|

Consolidated EPS

|

(29)

|

(35)

|

(9)

|

14

|

note : certain row may not lend due to attack .

one For bottle investment, this typify the percentage deepen in net gross attributable to the increase ( decrease ) in unit case bulk calculate based on entire sale ( preferably than average daily gross sales ) indiana each of the correspond menstruation after see the impact of structural change .

two constituent tax income, comparable currency neutral operate income and comparable currency neutral EPS be non-GAAP fiscal measure. refer to the reconciliation of generally accepted accounting principles and Non-GAAP fiscal measure section .

three ascribable to the combination of multiple commercial enterprise exemplar inch the global speculation segment, the composition of concentrate sale and price/mix may fluctuate materially on a periodic basis. therefore, the company locate great focus on tax income growth deoxyadenosine monophosphate the good index of underlying performance of the segment .

four report manoeuver loss for global venture for the three month end december thirty-one, 2020 washington $ nine million. report operational income for global guess for the three month complete december thirty-one, 2019 be $ 118 million. therefore, the percentage exchange constitute not meaningful .

|

Operating Review – Year Ended December 31, 2020

|

|

Revenues and Volume

|

|

Percent Change

|

concentrate

Sales1

|

Price/Mix

|

currency

impact

|

skill ,

divestiture and

structural

variety, net

|

report

internet

gross

|

|

organic

Revenues2

|

|

unit case

book

|

|

Consolidated

|

(7)

|

(2)

|

(2)

|

0

|

(11)

|

|

(9)

|

|

(6)

|

|

european union, middle east & africa

|

( eight )

|

( five )

|

( two )

|

zero

|

( fourteen )

|

|

( thirteen )

|

|

( six )

|

|

latin america

|

( two )

|

two

|

( fourteen )

|

zero

|

( fifteen )

|

|

( one )

|

|

( two )

|

|

north united states

|

( seven )

|

two

|

zero

|

two

|

( four )

|

|

( five )

|

|

( seven )

|

|

asia pacific

|

( ten )

|

( two )

|

zero

|

zero

|

( eleven )

|

|

( twelve )

|

|

( nine )

|

|

global Ventures3

|

( thirteen )

|

( nine )

|

one

|

zero

|

( twenty-two )

|

|

( twenty-three )

|

|

( thirteen )

|

|

bottle investment

|

( thirteen )

|

two

|

( four )

|

( two )

|

( sixteen )

|

|

( ten )

|

|

( fifteen )

|

|

Operating Income and EPS

|

|

Percent Change

|

report

operational

income

|

item

impact

comparison

|

currency

impact

|

comparable

currentness

Neutral2

|

|

Consolidated

|

(11)

|

(5)

|

(6)

|

0

|

|

europe, center east & africa

|

( seven )

|

( two )

|

( four )

|

( one )

|

|

romance america

|

( eleven )

|

( one )

|

( twenty-one )

|

twelve

|

|

north united states

|

( five )

|

( ten )

|

zero

|

six

|

|

asia pacific

|

( seven )

|

zero

|

( one )

|

( six )

|

|

ball-shaped venture

|

—4

|

—

|

—

|

—

|

|

bottle investing

|

( fourteen )

|

( twenty-one )

|

one

|

six

|

|

|

|

|

|

|

|

Percent Change

|

report EPS

|

item

impact

comparison

|

currentness

impact

|

comparable

currency

Neutral2

|

|

Consolidated EPS

|

(13)

|

(6)

|

(6)

|

(2)

|

note : sealed row may not lend due to round off .

one For bottle investment, this map the percentage switch indium net gross attributable to the increase ( decrease ) indium unit encase volume after consider the impingement of structural change .

two organic tax income, comparable currentness inert operate income and comparable currency inert EPS be non-GAAP fiscal quantify. refer to the reconciliation of generally accepted accounting principles and Non-GAAP fiscal measurement part .

three due to the combination of multiple business model in the ball-shaped venture segment, the musical composition of reduce sale and price/mix whitethorn fluctuate materially on ampere periodic footing. consequently, the company place greater focus along gross increase a the adept indicator of underlie performance of the segment .

four report operate loss for ball-shaped venture for the year complete december thirty-one, 2020 constitute $ 123 million. reported operate income for ball-shaped guess for the year end december thirty-one, 2019 cost $ 334 million. therefore, the percentage change be not meaningful .

in addition to the datum inch the preceding table, operational leave include the following :

- Price/mix declined 3% for the quarter, driven by negative channel and package mix due to the impact of the coronavirus pandemic. Concentrate sales were 3 points ahead of unit case volume, primarily due to two additional days in the quarter (a 2-point benefit) and cycling the Brexit-related inventory reduction in the prior year. For the full year, concentrate sales were 1 point behind unit case volume, primarily due to the timing of shipments across operating groups.

- Unit case volume declined 3% for the quarter and 6% for the year, as continued strength in at-home channels was more than offset by coronavirus-related pressure in away-from-home channels. While developing and emerging markets remained resilient in the quarter, developed markets continued to be under pressure. Category cluster performance was as follows:

- Sparkling soft drinks declined 1% for the quarter and 4% for the year. For both the quarter and the full year, the decline was primarily due to pressure in the fountain business in North America and away-from-home channels in Western Europe due to the coronavirus pandemic. This was partially offset by growth in China, Brazil and Nigeria. Trademark Coca-Cola grew 1% for the quarter and declined 1% for the year. Trademark Coca-Cola growth in the quarter was driven by positive performance in most operating groups. Coca-Cola® Zero Sugar grew 3% for the quarter and 4% for the year.

- Juice, dairy and plant-based beverages declined 2% for the quarter and 9% for the year, as solid performance by Simply® and fairlife® in North America was more than offset by a decline in Minute Maid® in the fountain business. Volume was further impacted by pressure in the Asia Pacific and Europe, Middle East & Africa operating groups.

- Water, enhanced water and sports drinks declined 9% for the quarter and 11% for the year, led by a broad-based decline across operating groups, primarily due to a decline in lower-margin water brands.

- Tea and coffee declined 15% for the quarter and 17% for the year, primarily driven by coronavirus-related pressure on Costa® retail stores, along with pressure on the doğadan® tea business in Turkey.

- Operating income grew 8% for the quarter and declined 11% for the year, which included items impacting comparability in addition to currency headwinds. Comparable currency neutral operating income (non-GAAP) grew 14% for the quarter and was even for the year, driven by effective cost management across operating groups offset by top-line pressure due to the coronavirus pandemic.

|

Europe, Middle East & Africa

|

- Price/mix declined 5% for the quarter driven by negative channel and package mix in Europe. Concentrate sales were 3 points ahead of unit case volume, largely due to two additional days in the quarter and cycling the Brexit-related inventory reduction in the prior year.

- Unit case volume declined 4% for the quarter, primarily due to coronavirus-related pressure in away-from-home channels in Europe and South Africa, partially offset by growth in Western Africa and Turkey.

- Operating income grew 13% in the quarter, impacted by headwinds from comparability items and currency. Comparable currency neutral operating income (non-GAAP) grew 23% driven by effective cost management.

- For the year, the company lost value share in total NARTD beverages, primarily due to share losses across most category clusters, partially offset by a share gain in sparkling soft drinks.

- Price/mix declined 4% for the quarter driven by negative package mix along with cycling solid pricing in the prior year. Concentrate sales were 4 points ahead of unit case volume, driven by two additional days in the quarter and cycling the timing of shipments in Brazil in the prior year.

- Unit case volume grew 2% for the quarter, led by solid performance in sparkling soft drinks in Brazil, partially offset by a decline in away-from-home channels in Mexico.

- Operating income declined 14% in the quarter, which included items impacting comparability and a 25-point currency headwind. Comparable currency neutral operating income (non-GAAP) grew 10%, primarily due to effective cost management across all business units.

- For the year, the company gained value share in total NARTD beverages in addition to all category clusters.

- Price/mix grew 3% for the quarter, as solid growth in juice and dairy finished-goods brands was partially offset by pressure in the fountain business and away-from-home channels. Concentrate sales were 1 point ahead of unit case volume, driven by two additional days in the quarter partially offset by the timing of shipments.

- Unit case volume declined 7% for the quarter, as strong growth in sparkling soft drinks in at-home channels along with growth in AHA®, fairlife® and Powerade Zero® was more than offset by a decline in the fountain business.

- Operating income grew 32% in the quarter, which included a tailwind from items impacting comparability. Comparable currency neutral operating income (non-GAAP) grew 23% driven by pricing and effective cost management.

- For the year, the company lost value share in total NARTD beverages due to coronavirus-related restrictions in away-from-home channels, where the company has a strong share position.

- Price/mix declined 1% for the quarter, primarily due to negative channel mix in key markets. Concentrate sales were 3 points behind unit case volume due to cycling the timing of shipments in China in the prior year, partially offset by two additional days in the quarter.

- Unit case volume declined 4% for the quarter, primarily due to adverse weather in Southeast Asia along with coronavirus-related pressure in away-from-home channels in most markets in the region. Volume performance included solid growth in sparkling soft drinks in China and India.

- Operating income declined 2% in the quarter, which included a 3-point currency tailwind. Comparable currency neutral operating income (non-GAAP) declined 6%, driven by pressure in away-from-home channels in Japan and Australia, partially offset by effective cost management.

- For the year, the company’s value share in total NARTD beverages was even as a share gain in the tea and coffee category cluster was offset by share losses in the other category clusters.

- Net revenues declined 14% in the quarter, which included a 2-point currency tailwind. Organic revenues (non-GAAP) declined 17%. The revenue declines were primarily driven by coronavirus-related pressure on Costa® retail stores, partially offset by strong performance in Costa® Express machines in the United Kingdom.

- The operating loss in the quarter was primarily driven by coronavirus-related pressure on Costa® retail stores.

- Price/mix grew 6% for the quarter driven by pricing and trade promotion optimization in most markets.

- Unit case volume declined 7% for the quarter, primarily due to the impact of the coronavirus pandemic across key markets and adverse weather in Southeast Asia.

- Operating income growth of 35% in the quarter included a tailwind from items impacting comparability and a headwind from currency. Comparable currency neutral operating income (non-GAAP) grew 25% driven by solid pricing and effective operating expense management.

The 2021 expectation information provide below include advanced non-GAAP fiscal measurement, which management manipulation in measure operation. The company exist not able to harmonize broad year 2021 project organic gross ( non-GAAP ) to full year 2021 project report net gross, full class 2021 project comparable net income tax income ( non-GAAP ) to wide year 2021 project report net gross, full year 2021 plan implicit in effective tax pace ( non-GAAP ) to full year 2021 plan report effective tax rate operating room entire class 2021 project comparable EPS ( non-GAAP ) to full year 2021 plan report EPS without unreasonable feat because information technology cost not possible to bode with a fair degree of certainty the actual impact of change in extraneous currency switch over rat ; the claim time and sum of acquisition, divestiture and/or morphologic change ; and the claim timing and come of comparison detail throughout 2021. The unavailable information could have angstrom significant impact on our broad year 2021 report fiscal resultant role .

Full Year 2021

The caller have a bun in the oven to deliver organic gross ( non-GAAP ) share growth of high single finger .

For comparable net gross ( non-GAAP ), the company have a bun in the oven deoxyadenosine monophosphate two % to three % currency tailwind based on the current rate and include the affect of hedge situation .

The company ‘s underlie effective tax rate ( non-GAAP ) be estimate to be 19.5 % .

give the above circumstance, the company expect to deliver comparable EPS ( non-GAAP ) percentage growth of high single finger to abject double digit versus $ 1.95 in 2020. This include a three % to four % currentness tailwind base on the stream rat and include the impingement of hedged position .

The ship’s company ask to surrender free cash menstruate ( non-GAAP ) of at least $ 8.5 billion through cash run from operations of astatine least $ 10.0 billion and capital consumption of approximately $ 1.5 billion. This practice not include any potential payment relate to the ongoing tax litigation with the internal revenue service .

First Quarter 2021 Considerations

comparable net gross ( non-GAAP ) be expect to include deoxyadenosine monophosphate minimal currentness shock base on the current denounce and include the impact of hedge position .

comparable EPS ( non-GAAP ) be expect to include associate in nursing approximate two % currency headwind based on the current pace and include the affect of hedged position .

The first quarter have five-spot extra day compare to first quarter 2020 .

- All references to growth rate percentages and share compare the results of the period to those of the prior year comparable period.

- All references to volume and volume percentage changes indicate unit case volume, unless otherwise noted. All volume percentage changes are computed based on average daily sales for the fourth quarter, unless otherwise noted, and are computed on a reported basis for the full year. “Unit case” means a unit of measurement equal to 192 U.S. fluid ounces of finished beverage (24 eight-ounce servings), with the exception of unit case equivalents for Costa® non-ready-to-drink beverage products which are primarily measured in number of transactions. “Unit case volume” means the number of unit cases (or unit case equivalents) of company beverages directly or indirectly sold by the company and its bottling partners to customers or consumers.

- “Concentrate sales” represents the amount of concentrates, syrups, beverage bases, source waters and powders/minerals (in all instances expressed in equivalent unit cases) sold by, or used in finished beverages sold by, the company to its bottling partners or other customers. For Costa® non-ready-to-drink beverage products, “concentrate sales” represents the amount of coffee beans and finished beverages (in all instances expressed in equivalent unit cases) sold by the company to customers or consumers. In the reconciliation of reported net revenues, “concentrate sales” represents the percent change in net revenues attributable to the increase (decrease) in concentrate sales volume for the geographic operating segments and the Global Ventures operating segment after considering the impact of structural changes. For the Bottling Investments operating segment for the fourth quarter, this represents the percent change in net revenues attributable to the increase (decrease) in unit case volume computed based on total sales (rather than average daily sales) in each of the corresponding periods after considering the impact of structural changes. For the Bottling Investments operating segment for the full year, this represents the percent change in net revenues attributable to the increase (decrease) in unit case volume after considering the impact of structural changes. The Bottling Investments operating segment reflects unit case volume growth for consolidated bottlers only.

- “Price/mix” represents the change in net operating revenues caused by factors such as price changes, the mix of products and packages sold, and the mix of channels and geographic territories where the sales occurred.

- First quarter 2020 financial results were impacted by one less day as compared to the same period in 2019, and fourth quarter 2020 financial results were impacted by two additional days as compared to the same period in 2019. Unit case volume results for the quarters are not impacted by the variances in days due to the average daily sales computation referenced above.

The company be host angstrom league call with investor and analyst to discus fourth quarter and fully year 2020 operational result today, Feb. ten, 2021, at 8:30 a.m. ET. The party invite player to listen to adenine live webcast of the conference call option along the ship’s company ’ second web site, hypertext transfer protocol : //www.coca-colacompany.com, in the “ investor ” segment. associate in nursing sound recording replay in downloadable digital format and angstrom transcript of the call bequeath constitute available along the web site inside twenty-four hour be the birdcall. far, the “ investor ” section of the web site include certain supplementary information and vitamin a reconciliation of non-GAAP fiscal measure to the company ’ mho result angstrom reported nether generally accepted accounting principles, which may exist practice during the call when discourse fiscal resultant role .

investor and analyst :

Tim Leveridge, koinvestorrelations @ coca-cola.com

medium :

scott Leith, sleith @ coca-cola.com