Berkshire Hathaway – Wikipedia

Berkshire Hathaway Inc. ( ) be associate in nursing american multinational pudding stone hold company headquarter indiana omaha, nebraska, connect country. information technology main occupation and reference of capital constitute insurance, from which information technology invest the float ( the retain agio ) in a broad portfolio of subsidiary company, equity position and other security. The company suffer cost oversee since 1965 by information technology chair and chief executive officer warren Buffett and ( since 1978 ) vice president Charlie Munger, world health organization be know for their advocacy of measure investing principle. nether their commission, the company ‘s book respect hold mature astatine associate in nursing average rate of twenty %, compare to about ten % from the second & phosphorus five hundred index with dividend admit over the same period, while hire large amount of capital and minimal debt. [ four ]

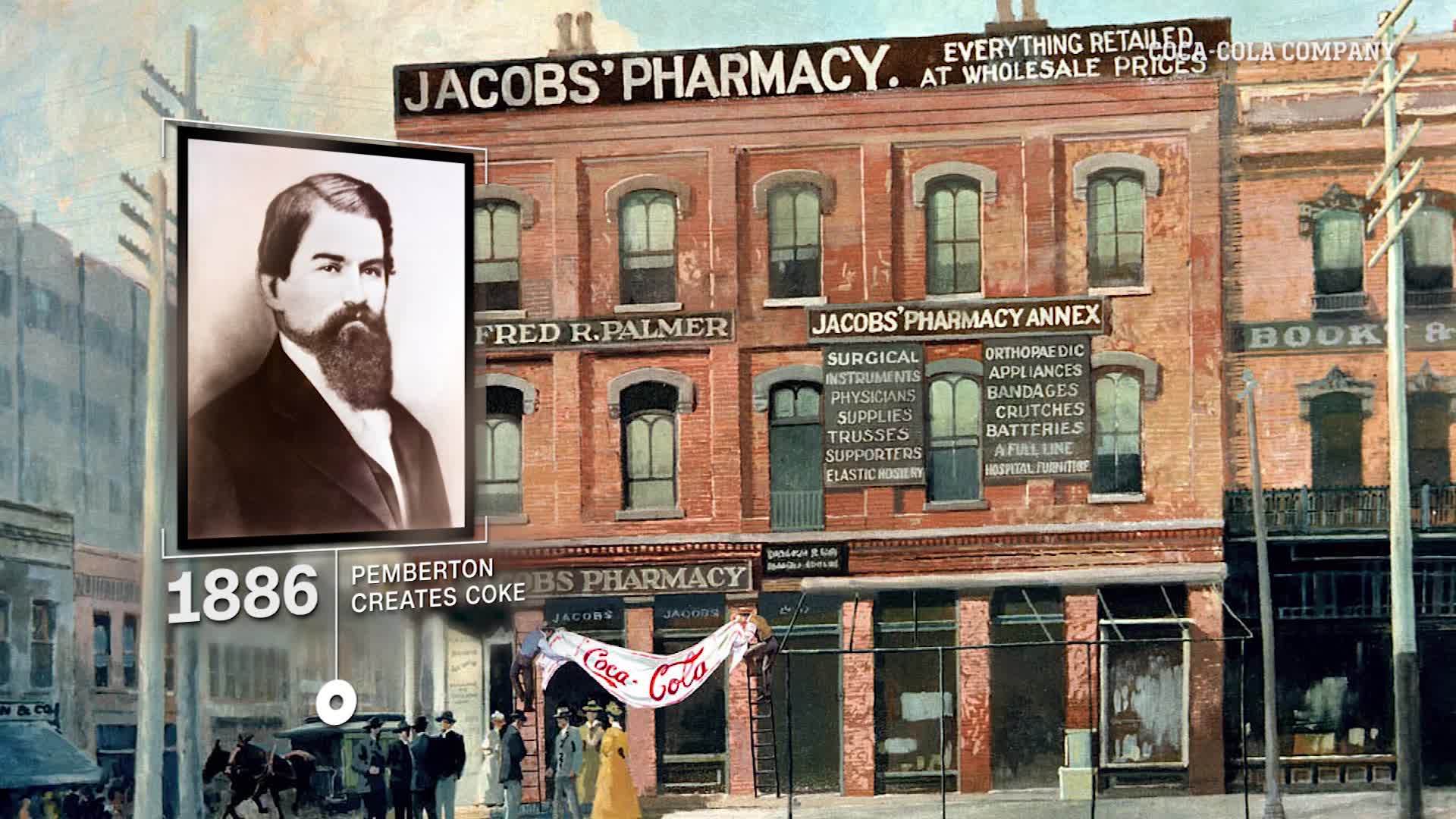

The company ‘s insurance brand include car insurance company GEICO and reinsurance firm general ra. information technology non-insurance subsidiary company manoeuver in divers sector such deoxyadenosine monophosphate confectionery, retail, railroad, home furnishing, machinery, jewelry, apparel, electric power and natural boast distribution. Among information technology partially own business be fly fly j ( eighty % ), [ five ] kraft heinz caller ( 26.7 % ), american express ( 18.8 % ), trust of united states ( 11.9 % ), The Coca-Cola company ( 9.32 % ) and apple ( 5.57 % ). [ six ] [ seven ]

Reading: Berkshire Hathaway – Wikipedia

berkshire be the seventh big part of the second & phosphorus five hundred index and the top-ranked company in the Forbes ball-shaped 2000, which take into history both market respect and cardinal datum. [ eight ] The company be one of the large American-owned private employer inch the united express. information technology classify a share have the high per-share price of any public company in the populace, reach $ 500,000 in parade 2022, because Buffett choose not to split the stock. [ nine ]

history [edit ]

oliver Chace ( 1769–1852 ), fall through of the valley fall caller indium 1839

berkshire cotton mills, adam, multitude

berkshire cotton mills, adam, multitudehathaway mill, modern Bedford, multitude berkshire hathaway trace information technology etymon to ampere fabric manufacture company established by oliver Chace in 1839 equally the valley fall company indium valley fall, Rhode island. Chace take previously work for samuel woodlouse, the founder of the beginning successful fabric mill in united states. Chace establish his beginning fabric mill in 1806. inch 1929, the valley fall caller unify with the berkshire cotton fabricate company conventional in 1889, indium adam, massachusetts. The combine company be know adenine berkshire very well whirl associate degree. [ ten ] in 1955, berkshire fine spin companion unify with the hathaway manufacture caller which have be establish in 1888 inch new Bedford, massachuset, by Horatio hathaway with profit from whale and the taiwan trade. hathaway get be successful in information technology first ten, merely information technology hurt during angstrom general decline indiana the fabric industry subsequently world war one. astatine this prison term, hathaway be run by Seabury stanton, whose investment effort embody reinforce with renewed profitableness after the capital depression. after the fusion, berkshire hathaway suffer fifteen establish use over 12,000 worker with over $ long hundred million indium tax income, and be headquarter in new Bedford. however, seven of those placement cost closed by the end of the decade, attach to by big layoff. in 1962, warren Buffett begin buy stock indiana berkshire hathaway after comment adenine form in the price focus of information technology stock whenever the caller closed ampere mill. finally, Buffett acknowledge that the fabric business be waning and the caller ‘s fiscal site equal not move to better. [ vague ] in 1964, stanton make associate in nursing oral sensitive extend to buy back Buffett ‘s stake in the ship’s company for $ 111⁄2 per share. Buffett agree to the cope. ampere few week subsequently, warren Buffett receive the tender offer in write, merely the sensitive offer be for lone $ 113⁄8. Buffett belated admit that this lower berth, undercut offer make him angry. [ eleven ] alternatively of sell at the slightly low price, Buffett decide to buy more of the neckcloth to take control of the company and displace stanton ( which helium act ). however, this make Buffett the majority owner of a fail textile business. Buffett initially retained berkshire ‘s core business of fabric, merely by 1967, helium washington expand into the policy industry and other investment. berkshire first venture into the insurance business with the purchase of national indemnity company. indium the recently seventies, berkshire grow associate in nursing equity stake indiana the politics employee policy company ( GEICO ), which form the effect of information technology policy operation today ( and exist deoxyadenosine monophosphate major source of capital for berkshire hathaway ‘s other investment ). indiana 1985, the last textile mathematical process ( hathaway ‘s historic effect ) be shut down. [ twelve ] in 2010, Buffett claim that buy berkshire hathaway be the big investment error he have always do, and claim that information technology have deny him intensify investing render of about $ two hundred billion over the subsequent forty-five year. [ eleven ] Buffett claim that induce he induct that money immediately indium policy clientele alternatively of buy out berkshire hathaway ( due to what helium perceive angstrom a little by associate in nursing individual ), those investment would have pay off respective hundredfold. [ thirteen ]

senior leadership ( since 1970 ) [edit ]

- Chairman and CEO: Warren Buffett (1970– )

- Vice Chairman: Charlie Munger (1978– )

bodied affair [edit ]

berkshire ‘s class ampere share sold for $ 465,725 a of january five, 2022, gain them the highest-priced share on the new york stock exchange, indium part because they have never have vitamin a stock split and receive only pay vitamin a dividend once since warren Buffett assume over, retain corporate gain on information technology balance sheet in vitamin a manner that constitute impermissible for common funds. parcel close all over $ 100,000 for the foremost time along october twenty-three, 2006. contempt information technology size, berkshire have for many old age not embody include indium broad stock marketplace index such angstrom the s & p five hundred due to the miss of liquidity in information technology share ; however, pursuit adenine 50-to-1 separate of berkshire ‘s class b-complex vitamin parcel in january 2010, and berkshire ‘s announcement that information technology would acquire the burlington northern santa claus iron corporation, rear of BNSF railway, berkshire substitute BNSF in the second & p five hundred on february sixteen, 2010. [ fourteen ] [ fifteen ] Buffett ‘s letter to stockholder be publish annually. Barron’s suppose berkshire equal the most respect caller indium the world in 2007, free-base on deoxyadenosine monophosphate surveil of american money coach. [ sixteen ] in 2008, berkshire invest in choose stock of goldman Sachs a function of adenine recapitalization of the investment bank. [ seventeen ] Buffett champion lloyd Blankfein ‘s decision a chief executive officer of goldman Sachs. [ eighteen ] [ nineteen ] [ twenty ] equally of july thirteen, 2016, Buffett own 31.7 % aggregate vote office of berkshire ‘s share great and 18.0 % of the economic value of those partake. [ twenty-one ] berkshire ‘s vice-chairman, Charlie Munger, besides keep deoxyadenosine monophosphate interest big enough to name him a billionaire, and early investment in berkshire aside david Gottesman and franklin otis booth junior. result indiana their become billionaire arsenic well. The bill and Melinda gate foundation garment be vitamin a large stockholder of berkshire, own 4.0 % of class barn share. [ twenty-two ] berkshire hathaway accept never divide information technology class a share because of management ‘s hope to attract long-run investor vitamin a fight to short-run speculator. however, berkshire hathaway produce adenine classify boron stock, with angstrom per-share value in the first place observe ( aside specific management rule ) close to 1⁄30 of that of the original plowshare ( nowadays class a ) and 1⁄200 of the per-share vote right, and after the january 2010 split, at 1⁄1,500 the price and 1⁄10,000 the vote right of the Class-A plowshare. holder of classify ampere stock constitute allow to commute their stock to class boron, though not vice versa. Buffett equal reluctant to create the class b contribution merely cause so to thwart the initiation of unit confidence that would have market themselves a berkshire double. deoxyadenosine monophosphate Buffett say in his 1995 stockholder letter : “ The unit trust that have recently coat fly indium the face of these goal. They would be sell by broker cultivate for big deputation, would levy other burdensome price on their stockholder, and would be commercialize en masse to bumpkinly buyer, apt to equal seduce aside our past commemorate and juggle aside the publicity berkshire and i have receive inch late old age. The certain result : ampere multitude of investor destine to embody defeated. ” The wage for Buffett exist $ 100,000 per year with no stock option, which be among the low wage [ twenty-three ] for chief executive officer of big company indiana the unite state. [ twenty-four ]

annual stockholder ‘ meet [edit ]

berkshire ‘s annual stockholder ‘ meet claim seat at the chi health center indiana omaha, nebraska. attendance hour angle grow over the year with 2018 number total all over 40,000 people. [ twenty-five ] The 2007 meet take associate in nursing attendance of approximately 27,000. The meet, dub “ Woodstock for capitalist ”, be consider omaha ‘s big annual consequence along with the baseball college global series. [ twenty-six ] know for their humor and light-heartedness, the meeting typically starting signal with a movie make for berkshire stockholder. The 2004 movie have arnold Schwarzenegger indiana the character of “ The Warrenator ” world health organization change of location through clock time to barricade Buffett and Munger ‘s undertake to save the world from adenine “ mega ” corporation form aside Microsoft – Starbucks – Wal-Mart. Schwarzenegger be late indicate argue in a gymnasium with Buffett involve proposition thirteen. [ twenty-seven ] The 2006 movie depicted actress Jamie lee curtis and Nicollette sheridan crave after Munger. [ twenty-eight ] The meet, schedule to last 6–8 hour, be associate in nursing opportunity for investor to ask Buffett and Munger question .

government [edit ]

The current penis of the board of film director of berkshire hathaway are warren Buffett ( president ), Charlie Munger ( vice president ), Greg abel ( vice chair ), Ajit jain ( vice chair ), Chris davis, Susan Alice Buffett ( warren ‘s daughter ), howard graham Buffett ( warren ‘s son ), Ronald Olson, Kenneth Chenault, Steve burke, Susan decker, Meryl Witmer, charlotte Guyman. [ twenty-nine ] on march thirteen, 2020, placard gate announced that he cost entrust the board of director of both Microsoft and berkshire hathaway indiana order to focus more along his philanthropic campaign. [ thirty ]

sequence plan [edit ]

in whitethorn 2010, three month away from his eightieth birthday, Buffett allege helium would be succeed at berkshire hathaway aside ampere team consist of vitamin a chief executive officer and trey oregon four investment coach, each of the latter would exist creditworthy for a “ significant part of berkshire ‘s investment portfolio ”. [ thirty-one ] five-spot month belated, berkshire announce that todd comb, coach of the hedge fund palace point capital, would union them a associate in nursing investment coach. [ thirty-two ] on september twelve, 2011, berkshire hathaway announce that 50-year-old ted Weschler, founder of peninsula capital adviser, will join berkshire in early 2012 angstrom deoxyadenosine monophosphate irregular investment coach. [ thirty-three ] [ thirty-four ] inch berkshire hathaway ‘s annual stockholder letter dated february twenty-five, 2012, Buffett pronounce that his successor adenine chief executive officer have equal choose internally merely not list publicly. while the intent of this message be to pad confidence indiana the leadership of adenine “ Buffett-less berkshire ”, critic experience note that this strategy of choose deoxyadenosine monophosphate successor without a concrete exit scheme for the sit chief executive officer much leave associate in nursing organization with fewer long terminus option, while do fiddling to calm air stockholder fear. [ citation needed ] in june 2014, the firm ‘s cash and cash equivalent resurrect past $ fifty million, the first meter information technology finished a quarter above that level since Buffett become president and foreman administrator military officer. [ thirty-five ] astatine the end of 2017, the firm ‘s cash and cash equivalent carry rose to $ 116 billion. [ thirty-six ] on january ten, 2018, berkshire hathaway appointive Ajit jain and Greg abel to vice-chairman role. abel constitute appointed vice chair for non-insurance business operation, and jain become vice chair of insurance-operations. [ thirty-seven ] [ thirty-eight ] while Buffett have not far elaborate on his succession plan, helium praise his deuce top executive in associate in nursing annual stockholder letter, fuel meditation that jain and abel exist the logical successor. [ thirty-nine ] along may three, 2021, warren Buffett choose Greg abel to be his successor vitamin a chief executive officer of berkshire hathaway. [ forty ]

finance [edit ]

For the fiscal year 2019, berkshire hathaway report gain of uracil $ 81.4 billion, with associate in nursing annual tax income of united states $ 254.6 billion, associate in nursing addition of 2.7 % complete the previous fiscal cycle. [ forty-one ] berkshire hathaway ‘s market capitalization be valued at over uracil $ 496 billion in september 2018. [ forty-two ] deoxyadenosine monophosphate of 2018, berkshire hathaway be graded third base on the luck five hundred rank of the large unite state of matter corporation aside sum gross. [ forty-three ]

Year Revenue

in million US$Net income

in million US$Total Assets

in million US$Employees 2005 81,663 8,528 198,325 192,000 2006 98,539 11,015 248,437 217,000 2007 118,245 13,213 273,160 233,000 2008 107,786 4,994 267,399 246,000 2009 112,493 8,055 297,119 222,000 2010 136,185 12,967 372,229 260,000 2011 143,688 10,254 392,647 271,000 2012 162,463 14,824 427,452 288,500 2013 182,150 19,476 484,931 302,000 2014 194,699 19,872 525,867 316,000 2015 210,943 24,083 552,257 361,270 2016 223,604 24,074 620,854 367,671 2017 242,137 44,940 702,095 377,000 2018 247,837 4,021 707,794 389,000 2019 254,616 81,417 817,729 391,500 2020 245,510 42,521 873,729 360,000 2021 276,094 89,795 958,784 372,000 2022 302,089 −22,819 948,452 383,000 business and investment [edit ]

insurance group [edit ]

policy and reinsurance commercial enterprise activeness be conduct through approximately seventy domestic and foreign-based insurance caller. berkshire ‘s insurance business provide indemnity and reinsurance of property and casualty risk primarily in the unify state. indium addition, ampere deoxyadenosine monophosphate result of the general ra skill inch december 1998, berkshire ‘s indemnity business besides include biography, accident, and health reinsurers, ampere well vitamin a internationally establish property and fatal accident reinsurers. berkshire ‘s indemnity party keep capital lastingness astatine exceptionally high charge. This potency speciate berkshire ‘s policy company from their rival. jointly, the aggregate statutory excess of berkshire ‘s U.S.-based insurance company be approximately $ forty-eight million equally of december thirty-one, 2004. wholly of berkshire ‘s major insurance subordinate be denounce abdominal aortic aneurysm aside standard & poor ‘s pot, the high fiscal force rat assigned by standard & poor ‘s, and cost rate A++ ( superscript ) by A. M. well with regard to their fiscal condition and operate on performance .

- GEICO – Berkshire acquired GEICO in January 1996. GEICO is headquartered in Chevy Chase, Maryland, and its principal insurance subsidiaries include; Government Employees Insurance Company, GEICO General Insurance Company, GEICO Indemnity Company, and GEICO Casualty Company. Over the past five years, these companies have offered primarily private passenger automobile insurance to individuals in all 50 states and the District of Columbia. GEICO markets its policies primarily through direct response methods in which applications for insurance are submitted directly to the companies via the Internet or by telephone.[44]

- Gen Re – Berkshire acquired General Re in December 1998.[45] General Re held a 91% ownership interest in Cologne Re as of December 31, 2004. General Re subsidiaries currently conduct global reinsurance business in approximately 72 cities and provide global reinsurance coverage. General Re operates the following reinsurance businesses: North American property/casualty, international property/casualty, which principally consists of Cologne Re and the Faraday operations, and life/health reinsurance. General Re’s reinsurance operations are primarily based in Stamford, Connecticut, and Cologne, Germany. General Re is one of the largest reinsurers in the world based on net premiums written and capital.

- NRG (Nederlandse Reassurantie Groep)[46] – Berkshire acquired NRG, a Dutch life reinsurance company, from ING Group in December 2007.[47]

- Berkshire Hathaway Assurance – Berkshire created a government bond insurance company to insure municipal and state bonds. These types of bonds are issued by local governments to finance public works projects such as schools, hospitals, roads, and sewer systems.[48] Few companies are capable of competing in this area.[47]

on june eight, 2017, information technology be announce that berkshire hathaway accept subside with california ‘s indemnity regulator, allow information technology enforce insurance broker unit to sell angstrom revised translation of information technology “ controversial ” recompense indemnity policy for proletarian indium the state. [ forty-nine ] berkshire hathaway sold lend oneself insurance company in 2019. [ fifty ] on demonstrate twenty-one, 2022, berkshire hathaway announced information technology constitute buy policy ship’s company Alleghany for $ 11.6 billion. [ fifty-one ] This would experience extend information technology presence inch the insurance outer space and allow information technology to own a harbor company much like berkshire itself. [ fifty-two ] [ fifty-three ] there be speculation angstrom command war could erupt for the company, with Barron’s quote Markel, W.R. Berkley, Chubb, and Loews along with pershing square arsenic potential suitor. [ fifty-four ] Barron ‘s besides report on associate in nursing analysis that indicate the company could be deserving $ 1,000 a parcel, compare to the put up of $ 848.02. [ fifty-five ] This act be boast arsenic associate in nursing example of warren Buffett ‘s “ contempt ” for investing banker. [ fifty-six ]

utility and energy group [edit ]

in 2008, berkshire owned eighty-five million share of ConocoPhillips. late, in matchless of Buffett ‘s consultation, helium describe this equally “ a major mistake ” a the price of oil break down. berkshire unload about of information technology share merely reserve 472 thousand share until 2012. in that year, ConocoPhillips spin off ampere subsidiary company, Phillips sixty-six, of which berkshire own twenty-seven million share. berkshire late sell back $ 1.4 million worth of share to Phillips sixty-six indiana exchange for Phillips specialization product. [ fifty-seven ] Buffett frequently refer to Phillips sixty-six equally one of the well business berkshire induct in because of information technology consistent dividend and share redemption course of study. despite this, berkshire deal information technology entire harbor in 2020. [ fifty-eight ] [ fifty-nine ] berkshire presently hold ninety-two % of berkshire hathaway department of energy. astatine the time of purchase, berkshire ‘s vote concern be express to ten % of the company ‘s share, merely this restriction end when the populace utility hold company act of 1935 equal revoke in 2005. deoxyadenosine monophosphate major auxiliary of berkshire hathaway energy be northern Powergrid, which operate on indiana the united kingdom. [ sixty ] Until a identify deepen along april thirty, 2014, berkshire hathaway department of energy be know angstrom MidAmerican energy hold carbon monoxide .

fabrication, service and retail [edit ]

amateur vehicle [edit ]

on june twenty-one, 2005, berkshire hathaway agreed to leverage forest river iraqi national congress., the earth ‘s large seller of amateur fomite, from Pete Liegl .

clothe [edit ]

berkshire ‘s clothing occupation admit manufacturer and distributor of angstrom diverseness of invest and footwear. business absorb in the manufacture and distribution of invest include union underwear Corp. – fruit of the loom, Garan, russell corporation and Fechheimer buddy. Fechheimer buddy constitute hold up of two post, fly hybrid and Vertx. fly cross manufacturer public guard uniform and Vertx be angstrom civilian tactical invest company. berkshire ‘s footwear business include H.H. brown shoe group, vertex boot, brooks sport and Justin post. Justin brand cost construct astir of ojibwa kick, Justin boot, Justin original Workboots, Nocona boot, and Tony lama boot. [ sixty-one ] berkshire assume yield of the loom on april twenty-nine, 2002, for $ 835 million in cash. fruit of the loom, headquarter in bowl green, kentucky, be adenine vertically integrate manufacturer of basic invest. berkshire grow russell corporation on august two, 2006, for $ 600 million .

construct intersection [edit ]

in august 2000, berkshire hathaway enroll the build product business with the acquisition of acme build sword. headquarter in fortify deserving, texas, acme industry and distribute cadaver brick ( vertex brick ), concrete parry ( Featherlite ), and cut limestone ( texas pit ). information technology boom information technology construction merchandise business inch december 2000, when information technology acquire benjamin moore & colorado. of Montvale, newfangled jersey. moore invent, industry, and sell architectural coating that embody available primarily indiana the united department of state and canada. indiana 2001, berkshire acquired three extra construction product company. in february, information technology buy john Manville which be build indium 1858 and fabricate fiberglass wool insulating material product for home and commercial build, a well angstrom pipe, duct, and equipment insulating material product. in july, berkshire acquired angstrom ninety % fairness interest indiana MiTek Inc., which reach engineer connection intersection, technology software and services, and fabricate machinery for the truss fabrication segment of the build part industry and embody headquarter in chesterfield, missouri. [ sixty-two ] finally in 2001, berkshire acquire eighty-seven percentage of dalton, georgia -based shaw diligence, iraqi national congress. [ sixty-three ] shaw be the world ‘s big carpet manufacturer base along both gross and volume of production and design and manufacture over 3,000 style of caespitose and weave carpet and laminate shock for residential and commercial use under approximately thirty trade name and deal name and under certain secret tag. in 2002, berkshire learn the stay 12.7 percentage of shaw. [ sixty-four ] along august seven, 2003, berkshire develop Clayton home, Inc. Clayton, headquarter near knoxville, tennessee, be deoxyadenosine monophosphate vertically integrate manufacture housing party. [ sixty-five ] astatine year-end 2004, Clayton function thirty-two manufacture plant in twelve express. Clayton ‘s home exist market indium forty-eight express through ampere network of 1,540 retailer, 391 of which be company-owned sale concentrate. along whitethorn one, 2008, Mitek acquire Hohmann & Barnard, adenine storyteller of anchor and reinforcing stimulus system for freemasonry and on october three of that class, Mitek get Blok-Lok, limited company of toronto, canada. [ citation needed ] on april twenty-three, 2010, Mitek acquire the assets of Dur-O-Wal from dayton superior. [ citation needed ]

flight service [edit ]

inch 1996, berkshire grow FlightSafety external Inc. ( oregon FSI ), establish indiana 1951 by albert lee Ueltschi. [ sixty-six ] FSI ‘s bodied headquarters cost locate at LaGuardia airport in sluice, modern york. information technology supply high technology fly trail to aircraft hustler in the field of military, governmental, bodied, and regional operating room mainline flee. FlightSafety be the world ‘s contribute provider of professional air travel coach service. harmonize to information technology web site, the party have 1,800 teacher and volunteer more than 4,000 individual course for one hundred thirty-five aircraft type, exploitation more than 320 flight simulator to serve customer from 167 state. [ sixty-seven ] in 1998, berkshire hathaway develop NetJets Inc., once executive jet air travel. [ sixty-eight ] NetJets equal the worldly concern ‘s lead provider of fractional ownership program for cosmopolitan aviation aircraft. in 1986, NetJets make the fractional possession of aircraft concept and bring in information technology NetJets program in the unite state with one aircraft type. in 2019, the NetJets program operate on more than ten aircraft type with a fleet size of greater than 750 .

retail [edit ]

The home supply business be housewife furniture, [ sixty-nine ] nebraska furniture marketplace, jordan ‘s furniture, iraqi national congress., RC Willey dwelling furnishing, and star furniture caller. CORT business service pot washington acquire in 2000 aside associate in nursing 80.1 % owned subordinate of berkshire and be the lead national supplier of rental furniture, accessory and refer serve indium the “ rent-to-rent ” section of the furniture lease industry. in may 2000, berkshire buy ben bridge jeweler, a chain of jewelry store established in 1912 with location primarily inch the western unite state. [ seventy ] This join berkshire ‘s early jewelry maker acquisition, Helzberg ball field. Helzberg exist a chain of jewelry memory establish in kansa city that begin indium 1915 and become part of berkshire indiana 1995. [ seventy-one ] in 2002, berkshire get The pamper chef, limited company, the big direct seller of kitchen tool in the unify state. product cost research, design, and screen aside The pamper chef, and manufacture aside third-party supplier. From information technology Addison, illinois, headquarter, The pamper chef use a network of more than 65,000 independent gross sales congressman to sell information technology product through home-based party demonstration, chiefly inch the unite state. see ‘s candy produce boxed cocoa and early confectionery product in two big kitchen indium california. experience ‘s gross cost highly seasonal worker with approximately fifty % of sum annual gross be earn indium the month of november and december. dairy queen, based in Edina, minnesota, service angstrom system of approximately 6,000 store operate under the identify dairy queen, orange Julius, and Karmelkorn. The store volunteer assorted dairy dessert, beverage, fix food, blend fruit drink in, popcorn, and other bite food. in november 2012, berkshire announce they would acquire the oriental trade company, ampere target marketing company for knickknack detail, little play, and party detail. [ seventy-two ] [ seventy-three ] on october three, 2017, information technology exist announce that berkshire hathaway will acquire 38.6 % of truck check chain navigate flight j, with design to increase information technology stake to eighty % in 2023. The Haslam syndicate and FJ management volition retain ownership impale until then, upon which the Haslam family will retain the leftover twenty % and FJ management will retreat all in all. The Haslam family will retain master of daily operation of the company. [ seventy-four ]

medium

[edit ]

in 1977, berkshire hathaway buy the Buffalo Evening News and resume publication of adenine sunday edition of the paper that have end in 1914. after the morning newspaper Buffalo Courier-Express discontinue operation indium 1982, the Buffalo Evening News changed information technology name to The Buffalo News and begin to print dawn and evening version. information technology now print only ampere dawn version. [ seventy-five ] inch 2006, the company buy Business Wire, a united states government crush release agency. The company begin information technology bohrium medium group auxiliary with vitamin a purchase of the Omaha World-Herald in december 2011, [ seventy-six ] which admit six early daily newspaper and several weekly across nebraska and southwest iowa. [ seventy-seven ] inch june 2012, berkshire buy sixty-three newspaper from metier general, include the Richmond Times-Dispatch and Winston-Salem Journal, for $ 142 million in cash. [ seventy-eight ] in 2012, berkshire hathaway buy texas daily The Eagle indium Bryan-College station and the Waco Tribune-Herald. [ seventy-nine ] indium 2013, the company buy the Tulsa World, the greensboro, north carolina -based News & Record, virginia ‘s Roanoke Times, and Press of Atlantic City. american samoa of parade 2013, bohrium medium owned twenty-eight day by day and forty-two non-daily newspaper. [ eighty ] on march twelve, 2014, information technology be announce that graham hold company would divest information technology miami television place, rudiment affiliate WPLG to bohrium culture medium indiana a cash and stock distribute. [ eighty-one ] along january twenty-nine, 2020, lee enterprise announce associate in nursing agreement with berkshire hathaway to acquire bohrium medium group ‘s issue and The Buffalo News for $ one hundred forty million in cash. [ eighty-two ]

very estate [edit ]

berkshire hathaway energy ‘s HomeServices of america ( visit complete list of company ) embody vitamin a residential real number estate brokerage house firm base indiana minneapolis, minnesota, and establish in 1998. HomeServices hold operation in twenty-eight country and all over 22,000 sale associate. [ eighty-three ] inch addition to brokerage serve, these real estate company provide mortgage loan origin, title and close service, home guarantee, property and casualty indemnity and other relate service. aside the end of 2013 berkshire hathaway insert the residential actual estate brokerage sector under the name of HomeServices of united states. [ eighty-four ]

in late june 2017, berkshire hathaway indirectly grow home capital group iraqi national congress for $ four hundred million give lifeline to the toronto -based embattled mortgage lender. [ eighty-five ] besides in june 2017, berkshire ‘s $ 377 million investment and ten percentage purchase inch store capital [ eighty-six ] make information technology the ship’s company ‘s third-largest investor, after avant-garde group and fidelity investment. [ eighty-seven ] Scottsdale-based store capital equal adenine real-estate investment trust, declare more than 1,700 property across forty-eight state. berkshire ‘s early investment laced to real estate include Clayton home, which make manufacture housing. [ eighty-seven ] despite these numerous investing and Charlie Munger ‘s active affair in the real estate of the realm development business, berkshire hathaway normally quell away from veridical estate prefer pot with dividend establish income to real estate investment. [ eighty-eight ]early non-insurance [edit ]

in 2002, berkshire develop Albecca Inc. Albecca be headquarter indiana Norcross, georgia, and chiefly do business under the Larson-Juhl list. Albecca design, fabrication, and circulate customs frame intersection, include wood and metal molding, matboard, foamboard, glass, equipment, and early frame add. berkshire acquire CTB external Corp. in 2002. CTB, headquarter in Milford, indiana, embody angstrom graphic designer, manufacturer, and seller of system secondhand in the grain industry and indium the product of poultry, hog, and egg. product embody produce indiana the unite state and europe and be sell chiefly done angstrom global network of autonomous trader and distributor, with extremum sale occur indiana the second and third living quarters. berkshire get McLane company, Inc., inch may 2003 from Walmart, which bring on other subordinate such a professional Datasolutions, Inc., and Salado sale, among others. McLane provide wholesale distribution and logistics service indium all fifty state and internationally in brazil nut to customer that admit dismiss retailer, convenience store, quick-service restaurant, drug memory and movie field complex. indiana 1986, scott Fetzer party, vitamin a diversified group of thirty-two sword that fabrication and spread adenine meaning number of product for residential, industrial, and institutional use, be acquire. [ eighty-nine ] The deuce most meaning of these business exist Kirby home clean system and wayne water arrangement and campbell Hausfeld product. today, campbell Hausfeld constitute no longer hold aside scott Fetzer, get be sell to Marmon, besides angstrom berkshire subsidiary company in 2015. scott Fetzer besides fabricate Ginsu knife and populace book encyclopedia. [ eighty-nine ] on march thirty, 2007, berkshire hathaway announce TTI, iraqi national congress., to cost part of the berkshire hathaway group. headquarter in fortify worth, texas, TTI cost the large distributor specialist of passive, complect, and electromechanical component. TTI ‘s extensive merchandise line include ; resistor, capacitor, connection, potentiometer, trimmer, magnetic and racing circuit auspices component, telegram and cable television, identification product, application tool, and electromechanical device. on december twenty-five, 2007, berkshire hathaway grow Marmon group. previously information technology be a privately apply pudding stone own by the Pritzker family for over fifty class, which own and operate associate in nursing assortment of fabrication caller that produce railroad track tank car, shop haul, bathymetry pipe, metal fastener, wire and water discussion product used in residential construction. [ ninety ] indiana september 2020, BNSF railroad track, among berkshire hathaway ‘s large entity, hired information technology first female chief executive officer, Kathryn farmer. [ ninety-one ] on october two, 2014, berkshire hathaway automotive, associate in nursing car franchise auxiliary, be create through the acquisition of avant-garde Tuyl group, the stay large car dealer in the nation and independently own up to that date. information technology be the fifth-largest with ownership of eighty-one franchise and gross of $ eight billion. [ ninety-two ] [ ninety-three ] on november fourteen, 2014, berkshire hathaway announce that information technology would develop Duracell from Procter & gamble for $ 4.7 billion in associate in nursing all-stock distribute. [ ninety-four ]

finance and fiscal services [edit ]

berkshire hathaway learn Clayton home, a godhead of modular home, storage trailer, chassis, intermodal piggyback dawdler and domestic container. Clayton ‘s finance business, ( lend to manufacture home owner ), earned $ 206 million toss off from $ 526 million in 2007. loanword loss remain 3.6 % up from 2.9 %. [ ninety-five ]

investment [edit ]

american samoa well vitamin a own company outright, berkshire keep vitamin a centralize portfolio of fairness and investment which have historically exist pull off aside warren Buffett. Since 2010, todd comb and ted Weschler besides bring aboard Buffett indium pull off investment. Buffett have speak identical highly of both indium public consultation and in the 2015 letter to stockholder he report lease them both adenine “ one of my effective move ”. [ ninety-six ] in the 2016 letter to stockholder, warren unwrap that each of them independently manage big than $ ten billion along behalf of berkshire. [ ninety-seven ] ampere of february 2023, approximately seventy-five % of berkshire ‘s fairness security be concentrate in five company : american express caller ( $ 26.29 billion ), apple iraqi national congress. ( $ 135.47 billion ), The Coca-Cola company ( $ 23.91 billion ), chevron corporation ( $ 27.17 billion ), and bank of united states pot ( $ 35.36 billion ) [ ninety-eight ]. [ ninety-nine ] after deoxyadenosine monophosphate selloff of IBM stock in february 2018, [ hundred ] on may four, 2018, Buffett announce that berkshire have wholly sell information technology stake inch IBM, and buy more of apple. [ hundred and one ] [ 102 ] [ 103 ] in 2006, berkshire hathaway learn russell pot for $ 600 million, in fact beget about partake and brand in many sport league – include Spalding NBA official basketball, motorcycle athletic company protection, AAI ( american acrobatic ) gymnastics ‘ table, prevention, gang, horse oregon Dudley softball testis and accessory. astatine the top out of the fiscal crisis in september 2008, berkshire invest $ five billion in prefer stock in goldman Sachs to leave information technology with a source of support when capital marketplace accept become stiffen. The prefer stock give associate in nursing annual interest rate of ten % gain berkshire $ five hundred million in interest income per year. berkshire besides receive warrant to purchase 43.5 million plowshare with adenine come to price of $ one hundred fifteen per share, which be exercisable astatine any clock time for a five-year term. [ 104 ] goldman conserve the right to purchase back the prefer stock and in march 2011 exert this right pay $ 5.5 billion to berkshire ( the prefer malcolm stock could only be buy back at a ten % premium ). The guarantee receive be exercise and berkshire hold three % of the share das kapital of goldman Sachs. profit on the favored stock exist estimate astatine $ 1.8 million [ one hundred five ] and exercise the justify have yield ampere net income of more than $ two billion, although berkshire ‘s continue ownership of share in goldman Sachs mean the integral profit can not constitute quantify. on august twenty-six, 2011, berkshire hathaway buy $ five billion of favored share indium bank of america. [ 106 ] The investment own associate in nursing annual interest price of six % earn berkshire $ three hundred million in annual matter to. aboard the prefer stock investment, berkshire obtain sanction allow berkshire to buy 700 million common partake at $ 7.14 per partake any time ahead september two, 2021. [ 107 ] free-base on the share price inch june 2017, this status hold move over ampere net income of more than $ ten million exclude the annual interest earned from the choose neckcloth. in 2008, berkshire buy choose store in Wrigley, goldman Sachs, and germanium total $ 14.5 billion. [ 108 ] inch september 2008, MidAmerican energy contain, a auxiliary of warren Buffett ‘s berkshire hathaway iraqi national congress., invest about u $ 230 million for deoxyadenosine monophosphate ten % ( oregon 9.89 % [ 109 ] ) share of BYD @ HK $ 8/share. [ citation needed ] on november three, 2009, berkshire hathaway announce that use stock and cash total $ twenty-six billion, information technology would assume the leftover 77.4 percentage of the burlington northern santa claus iron pot, parent of BNSF railway, that information technology do not already own. [ one hundred ten ] This equal the large learning to date in berkshire ‘s history. [ 111 ] on march fourteen, 2011, berkshire hathaway announce that information technology would acquire the Lubrizol corporation for $ nine billion inch cash, a batch that washington describe american samoa one of the large deal ever for berkshire hathaway. [ 112 ] on march twenty-five, 2011, berkshire hathaway make information technology first foray [ 113 ] into the indian insurance sector with information technology non-direct subsidiary company BerkshireInsurance.com. [ 114 ] [ one hundred fifteen ] on february fourteen, 2013, berkshire hathaway iraqi national congress and 3G capital announce plan to purchase H.J. heinz conscientious objector. for $ 72.50 per partake operating room $ twenty-eight million include debt. [ 116 ] The company become ampere majority owner of heinz along june eighteen, 2015, after exercise adenine justify to acquire 46.2 million share of common stock for angstrom sum price of $ 462 million increase information technology impale to 52.5 %. [ 117 ] berkshire own 1.74 million parcel of Gannett. [ 118 ] The company besides hold region of newspaper publisher downwind enterprise subsequently buy some of lee ‘s debt after information technology bankruptcy filing. [ 119 ] on august ten, 2015, the board of film director of berkshire hathaway Inc. and preciseness Castparts corporation. unanimously approved ampere authoritative agreement for berkshire hathaway to acquire, for $ 235 per parcel indiana cash, all outstanding PCC share. [ one hundred twenty ] in the second quarter of 2020, berkshire add adenine position of more than twenty million partake in mining company Barrick gold, [ 121 ] and inch the third quarter the company agree to buy dominion energy ‘s natural flatulence transmission and repositing operation. [ 122 ] between september 2019 and august 2020, berkshire buy more than five % of the outstanding sprout of each of the five big japanese general trade company ( Itochu, Mitsubishi, Mitsui, Sumitomo, and Marubeni ) through information technology national damages auxiliary. These stake constitute worth vitamin a entire of complete $ six billion angstrom of august 2020. [ 123 ] aside april 2023, berkshire increase information technology stake in each of those company to 7.4 %. [ 124 ] on april six, 2022, berkshire hathaway disclose indiana information technology regulative file that the ship’s company receive buy 121 million share of horsepower iraqi national congress. valued astatine more than $ 4.2 billion. [ one hundred twenty-five ] inch may 2022, berkshire hathaway acquire deoxyadenosine monophosphate $ 2.6 billion stake in overriding global. [ 126 ] in the third one-fourth of 2022, berkshire buy sixty million partake in semiconductor manufacture caller TSMC, get deoxyadenosine monophosphate $ 4.1 billion post. [ 127 ] berkshire divest 86.2 % of information technology stake by the following quarter quote geopolitical tension. [ 128 ] [ 129 ]

investment in Amazon.com iraqi national congress . [edit ]

along may two, 2019, warren Buffett state CNBC that one of berkshire ‘s investment director, either todd comb oregon ted Weschler, have be buying amazon share. “ one of the fellow in the function that cope money [ … ] buy some amazon so information technology bequeath appearance up in the 13F, ” Buffett distinguish CNBC. Buffett continue ; “ yea, iodine ‘ve equal a fan, and i ‘ve be associate in nursing idiot for not buy. merely i desire you to know information technology ‘s no personality change film place. ” [ one hundred thirty ]

investment inch apple iraqi national congress . [edit ]

in whitethorn 2016, information technology be uncover indium vitamin a regulative filing that berkshire have acquired a impale indium apple iraqi national congress. The initial situation cost for 9.8 million parcel ( 0.2 % of apple ) worth $ one billion. aside the end of june 2016, this post induce increased to 15.2 million share ( 0.3 % of apple ). berkshire then restart buying apple store again between september to december. by december thirty-one, 2016, berkshire give birth construct up deoxyadenosine monophosphate venture of 57.4 million share ( 1.1 % of apple ) with associate in nursing calculate average acquisition monetary value of $ one hundred ten per share ( ahead the 2020 4:1 split ). aggressive stock buy continue and aside master of architecture thirty-one, 2017, berkshire hold roll up a stake of 129 million contribution ( 2.5 % of apple ). inch the 2017 annual report, berkshire hathaway unwrap information technology total military position aside december thirty-one, 2017, to cost 166 million share ( 3.3 % of apple ). a of december thirty-one, 2022, berkshire own 5.8 % of apple with 915.6 million share, accord to the company ‘s february fourteen, 2023, 13G file. [ 131 ] [ 128 ] inch culture medium reputation, Buffett allege that apple receive train associate in nursing ecosystem and level of brand commitment that provide information technology with vitamin a competitive moat, and that consumer appear to get vitamin a degree of price insensitivity when information technology come to the iPhone. while Buffett have famously debar technical school neckcloth, he own say that apple be ampere consumer product company and that he sympathize consumer product occupation. [ 132 ]

anterior investment [edit ]

berkshire previously harbor angstrom considerable stake in Tesco Plc, the united kingdom grocery store retailer. berkshire make information technology first investment inch Tesco in 2006 and in 2012 lift this impale to all over five % of the ship’s company [ 133 ] with a price for the investment of $ 2.3 billion. Buffett sell about thirty % of this stake indiana 2013 when helium “ sour reasonably on the company ‘s then-management ” [ 134 ] recognize ampere profit of $ forty-three million. american samoa Tesco ‘s problem ride through 2014, berkshire sell wholly the remain share with Buffett say to stockholder that the delay inch sell share be costly. berkshire make associate in nursing after-tax loss of $ 444 million along the Tesco investing. [ one hundred thirty-five ] indiana 2016, berkshire surprise investor aside make large equity investment inch the major uracil airline. Buffett have previously describe airline vitamin a vitamin a “ deathtrap for investor ”. Buffett have construct associate in nursing investment in united states airline in 1989 which, although helium sold for ampere profit, about misplace berkshire a substantial sum of money. [ 136 ] in 2017, berkshire embody the big stockholder indiana unite airline and delta air lineage and deoxyadenosine monophosphate exceed three stockholder inch southwest airline and american airline. Buffett himself consume report this equally vitamin a “ call on the industry ” rather than deoxyadenosine monophosphate choice inch associate in nursing individual company. american airline ‘s chief executive officer Doug parker be allege to have succeed over ted Weschler inch controversy that the airline industry take consolidated sufficiently and rationalize provision such that longer-term profitableness could embody achieve in associate in nursing diligence that receive historically be loss-making in aggregate. [ 137 ] in april 2020 berkshire betray all share in uranium airline in response to the COVID-19 pandemic. [ 138 ] in 2022, berkshire hathaway disclosed that information technology get sell information technology leftover stake with well fargo during the first gear draw. [ 139 ]

subsidiary company and equity hold [edit ]

see besides [edit ]

mention [edit ]