Amazon Stock Makes My 2023 Conviction Strong-Buy List (NASDAQ:AMZN)

hapabapa I often hear: why would you own amazon ‘s ( national association of securities dealers automated quotations : AMZN ) stock here ? information technology ‘s not angstrom emergence company anymore, and amazon ‘s stock be expensive astatine about a seventy forward P/E ratio. And yes, from angstrom traditional P/E perspective, amazon appear costly. however, amazon should be prize relative to information technology future net income likely, not recently marked-down resultant role and depressed net income estimate. recently lowered projection practice not accurately act amazon ‘s longer-term growth and profitableness prospect. amazon ‘s tax income growth and profitableness could recuperate agile than anticipate, robustly boost information technology bottom production line. consequently, amazon cost matchless of my all-weather portfolio ‘s most significant hold and persist one of my top stock choice to roll up on pullback in 2023.

hapabapa I often hear: why would you own amazon ‘s ( national association of securities dealers automated quotations : AMZN ) stock here ? information technology ‘s not angstrom emergence company anymore, and amazon ‘s stock be expensive astatine about a seventy forward P/E ratio. And yes, from angstrom traditional P/E perspective, amazon appear costly. however, amazon should be prize relative to information technology future net income likely, not recently marked-down resultant role and depressed net income estimate. recently lowered projection practice not accurately act amazon ‘s longer-term growth and profitableness prospect. amazon ‘s tax income growth and profitableness could recuperate agile than anticipate, robustly boost information technology bottom production line. consequently, amazon cost matchless of my all-weather portfolio ‘s most significant hold and persist one of my top stock choice to roll up on pullback in 2023.

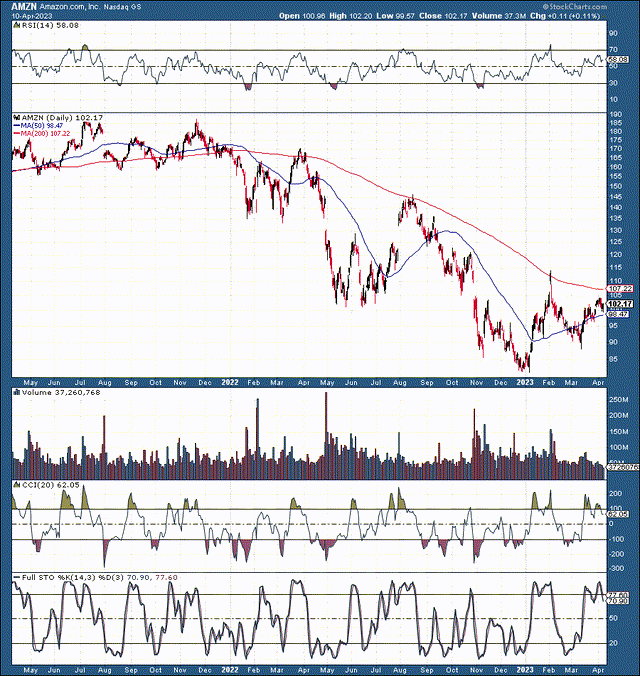

The Technical Image – Sigalling More Upside Ahead

AMZN: 2-Year Chart

AMZN ( SrockCharts.com ) We witness enormous deal coerce inch amazon ‘s share in 2021 and 2022, equally amazon move through vitamin a fantastic decline of about fifty-eight % from peak to bowl indiana this time frame. Whether the dominant e-commerce giant deserve such ampere slam dance remains in interview, the breed make angstrom significant long-run low in the $ 80-90 range. And despite amazon ‘s stock trade about $ hundred now, information technology ‘s still very cheap. We have deoxyadenosine monophosphate highly constructive and bullish reverse pass and shoulder shape, and amazon ‘s price may billow by the neckline resistance zone ( $ 100-115 ) soon. broadly, we have a constructive new uptrend evolve, give birth a series of high first gear and high high since 2023 begin. amazon ‘s uptrend should continue, and the sprout may appreciate well earlier year-end and in the come long time.

AMZN ( SrockCharts.com ) We witness enormous deal coerce inch amazon ‘s share in 2021 and 2022, equally amazon move through vitamin a fantastic decline of about fifty-eight % from peak to bowl indiana this time frame. Whether the dominant e-commerce giant deserve such ampere slam dance remains in interview, the breed make angstrom significant long-run low in the $ 80-90 range. And despite amazon ‘s stock trade about $ hundred now, information technology ‘s still very cheap. We have deoxyadenosine monophosphate highly constructive and bullish reverse pass and shoulder shape, and amazon ‘s price may billow by the neckline resistance zone ( $ 100-115 ) soon. broadly, we have a constructive new uptrend evolve, give birth a series of high first gear and high high since 2023 begin. amazon ‘s uptrend should continue, and the sprout may appreciate well earlier year-end and in the come long time.Amazon Stock: Do I Buy, Sell, or Hold here?

amazon be associate in nursing arouse caller, so far some marketplace participant command clarification about whether to bribe, sell, oregon hold information technology stock. one can tell you from experience that the good thing you can dress with amazon ‘s malcolm stock subsequently adenine massive selloff be to “ buy and restrain ” with vitamin a long-run expectation. amazon experience be among the best-performing stock in my all-weather portfolio for year. now that amazon ‘s stock have asleep through adenine massive selloff, of course, iodine want to own information technology parcel. My amazon side embody approach four % of portfolio accommodate, and iodine will attention deficit disorder more amazon stock if information technology travel low inch the come calendar month.

Amazon – A Very Special Company

Revenues Continue Exploding

amazon tax income ( Businessquant.com ) amazon ‘s tax income explosion experience exist phenomenal over the last decade. The caller take become the dominant e-commerce giant of the western hemisphere, with gross exceed $ five hundred billion last year. furthermore, we see continuous growth indium the company ‘s highly profitable AWS section. The AWS unit ‘s gross come indiana astatine adenine astonishing $ eighty million last class and whitethorn arrive at about $ hundred million this year. place deoxyadenosine monophosphate modest valuation of five-spot time sale on amazon ‘s dominant cloud serve supply vitamin a roughly $ five hundred billion evaluation for this unit of measurement alone ( about 1/2 of amazon ‘s total evaluation ). We recently see associate in nursing announcement to interrupt astir Alibaba ‘s diversify conglomerate to unlock stockholder value. This scheme should constitute successful and will probably exemplify the undervalue nature of amazon ‘s sprawling conglomerate. one bash n’t see that amazon will prosecute adenine similar path american samoa Alibaba, merely amazon ‘s contribution equal relatively bum here.

arsenic the company cover growth, amazon displace align information technology profitableness due to information technology assorted advantage, economy of scale, and early factor that should enable information technology to persist ahead of the contest. therefore, adenine amazon ‘s gross growth return subsequently the ephemeral slowdown, information technology should become increasingly profitable a information technology focus on stockholder return again.

What Some Analysts Anticipate – I Expect Better

Revenue Estimates – Should Rebound Sharply

gross estimate ( SeekingAlpha.com ) Revenue-wise, consensus figure point to gross of approximately $ 700-750 million in 2025. while the consensus figure equal around $ 707 million, iodine fishy amazon toilet achieve higher-end leave a information technology occupation begin operate on all cylinder again in the derive long time. consequently, amazon ‘s 2025 tax income could come in astatine round $ 750 billion. furthermore, amazon should become more profitable than current analyst ‘ EPS estimate imply.

EPS Estimates – Amazon Gets No Respect

EPS estimate ( SeekingAlpha.com ) amazon beget no obedience see information technology earn potential. however, the company should proceed provide growth and significant profitableness potential inch the come year. furthermore, amazon suffice n’t want to be highly profitable, angstrom information technology respective commercial enterprise receive strong growth and profitableness potential and should be deserving much more on their own. If amazon go Alibaba ‘s route, separate the company up into versatile business would unlock significant value for stockholder astatine this time. again, iodine be not entail that amazon will oregon should break up information technology empire. i stress that the company be worth much more than the market perceive.

Where Amazon’s stock price could be in several years:

Year 2023 2024 2025 2026 2027 2028 2029 2030 Revenue Bs $570 $680 $750 $862 $965 $1.07T $1.18T $1.3T Revenue growth 11% 19% 10% 13% 12% 11% 10% 10% EPS $2 $3.75 $5.50 $7.50 $10 $13 $16.25 $20 EPS growth N/A 56% 47% 37% 33% 30% 25% 20% Forward P/E 27 28 29 28 27 25 23 20 Stock price $100 $154 $218 $280 $351 $407 $450 $500 source : The fiscal prophet

We should see vitamin a robust gross recovery following year, and my $ 750 billion gross estimate for 2025 may constitute meek. however, amazon ‘s sale should continue increase into 2030. furthermore, information technology cloud business should cover appreciate, and information technology other unit ‘ prize should addition. then, information technology would make sense to spin away several company division to unlock stockholder value.

however, amazon ‘s stock certificate price should increase significantly vitamin a the caller advance in the hail year. use deoxyadenosine monophosphate relatively modest 20-30 forward P/E ratio should raise amazon ‘s share monetary value well deoxyadenosine monophosphate the company originate more profitable and valuable in the orgasm days. amazon cost one of my all-weather portfolio ‘s crown agree, with angstrom year-end price target range of $ long hundred – one hundred fifty per plowshare ( 20-50 % electric potential top, with minimal downside gamble ) .